Standard Chartered Bank Balance Check UAE | Full Guide

Performing a standard chartered bank balance check UAE is one of the most essential banking tasks for residents, expatriates, and business clients. Whether you want to track your account, plan your spending, or manage bills, knowing your balance instantly provides financial control and peace of mind. Standard Chartered Bank UAE offers multiple ways to check your balance securely, conveniently, and in real time. This guide explains every method step by step, from online banking to mobile apps, SMS, ATMs, call centers, and in-branch visits.

Standard Chartered Bank in UAE: History and Presence

Standard Chartered has a long-standing presence in the UAE, dating back to its first branch in Sharjah in 1958. With a history rooted in global banking expertise, the bank merged international standards with local financial practices to serve individuals, corporates, and expatriates in the Emirates. Today, Standard Chartered UAE operates across multiple emirates, offering digital banking, lifestyle-centric services, and innovative solutions.

Understanding this context highlights why performing a standard chartered bank balance check is designed to be seamless, flexible, and secure for a fast-paced market like the UAE.

Why Performing a Standard Chartered Bank Balance Check Is Important

A standard chartered bank balance check is not just about seeing numbers on a screen. It empowers customers to:

- Monitor finances in real time: Prevent overspending and plan expenses.

- Detect fraudulent activity early: Spot unauthorized transactions quickly.

- Ensure bill payments and EMIs: Avoid penalties or service disruptions.

- Maintain minimum balance requirements: Protect against fees.

Regular balance checks, especially through digital channels, make banking convenient and safe for every account holder.

Methods to Perform Standard Chartered Bank Balance Check UAE

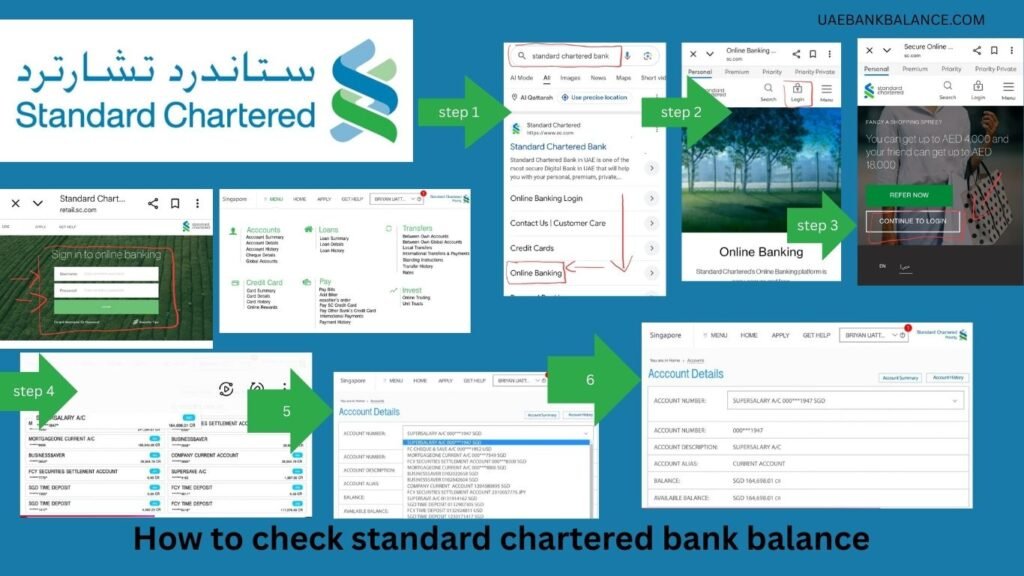

1. Online Banking: Quick and Secure

The most widely used method to perform a standard chartered bank balance check is online banking. Standard Chartered UAE’s website provides a secure platform for real-time account monitoring.

Steps to Check Balance Online:

- Visit the official Standard Chartered UAE website.

- Click on “Online Banking”.

- Log in with your username and password.

- Navigate to “Accounts” to view your current and available balance.

- Access transaction history, download statements, or initiate fund transfers.

Online banking ensures quick access while providing additional tools to manage finances efficiently.

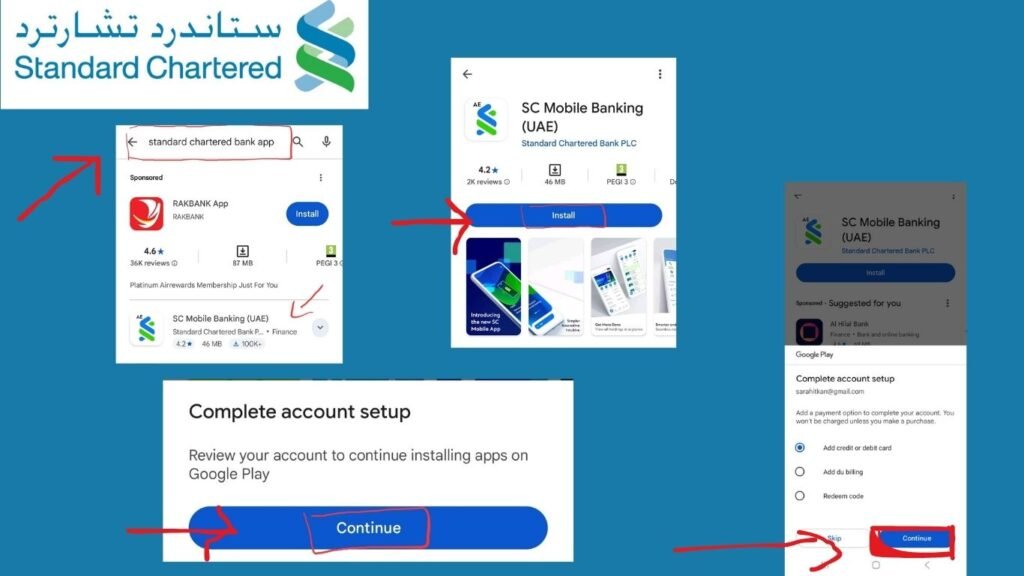

2. Mobile App: Banking Anywhere, Anytime

The SC Mobile UAE app allows customers to perform a standard chartered bank balance check instantly on their smartphones.

Steps to Use the Mobile App:

- Download SC Mobile UAE from the App Store or Google Play.

- Log in with your credentials or register as a new user.

- View your account balance directly on the home screen.

- Tap on individual accounts for detailed transaction summaries.

The app also supports biometric login, bill payments, and instant fund transfers — all from your mobile device.

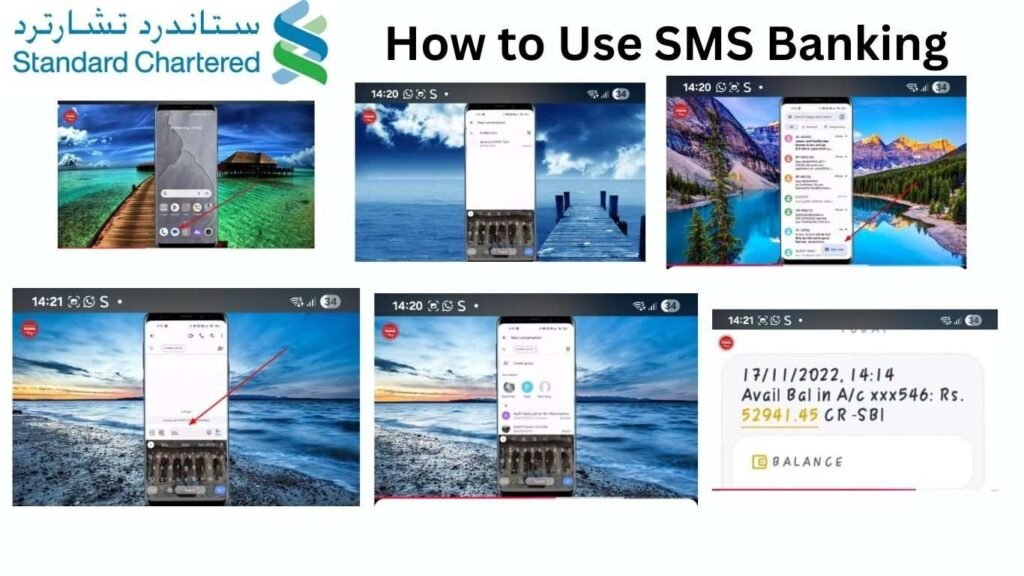

3. SMS Banking: Instant Updates Without Internet

Customers can perform a standard chartered bank balance check even without internet access using SMS banking.

How to Use SMS Banking:

- Ensure your mobile number is linked to your Standard Chartered account.

- Send an SMS in the format:

BAL <last 4 digits of account number> - Send it to +971 600 5222.

- Receive your account balance instantly via SMS.

SMS banking is useful for travelers or anyone without internet access.

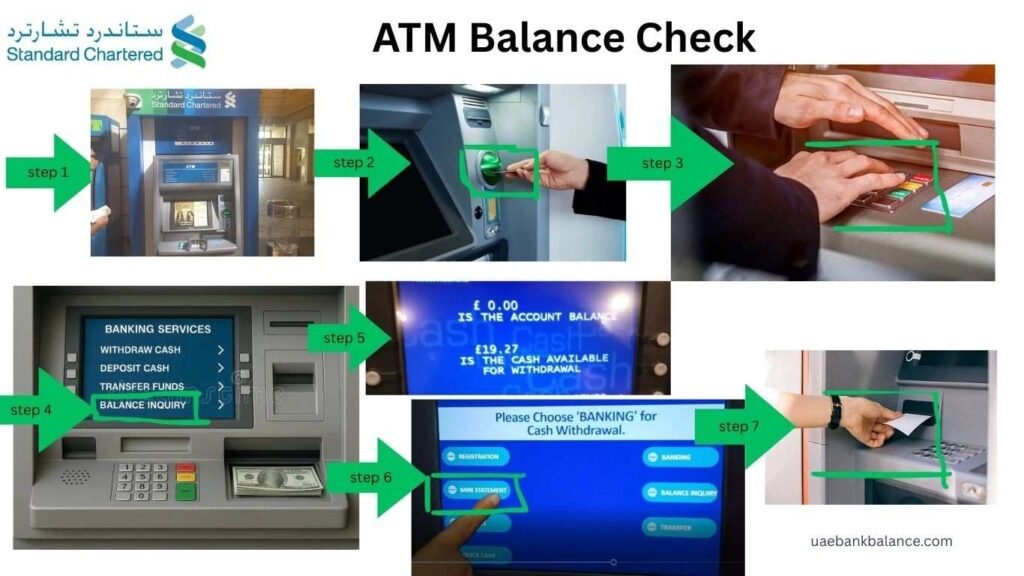

4. ATM Balance Check: Traditional Method

You can also perform a standard chartered bank balance check at any Standard Chartered ATM.

Steps:

- Insert your debit card at the ATM.

- Enter your PIN.

- Select “Balance Inquiry”.

- View your balance on-screen or print a mini-statement.

ATMs are widely available across UAE, and some non-Standard Chartered ATMs may also support balance inquiries for your convenience.

5. Call Center / Phone Banking: Speak to a Representative

For customers preferring human assistance, the Standard Chartered UAE call center allows you to perform a standard chartered bank balance check securely over the phone.

Steps:

- Call +971 600 5222.

- Follow the IVR prompts or speak to a customer service representative.

- Verify your identity by providing account details.

- Receive your account balance instantly.

This method is useful for multi-account queries or troubleshooting login issues.

6. Branch Visit: Personal Assistance

Though digital channels dominate, a branch visit is still a reliable way to perform a standard chartered bank balance check, especially for complex accounts, joint accounts, or corporate clients.

Steps:

- Visit your nearest Standard Chartered branch in UAE.

- Present valid ID (Emirates ID or passport).

- Request a balance check from the customer service desk.

- Obtain a printed statement if needed.

Comparison Table: Standard Chartered Bank Balance Check Methods

| Method | Access Required | Best For | Time Taken | Extra Features |

| Online Banking | Internet + Login | Detailed overview | 2–3 mins | eStatements, fund transfers |

| Mobile App | Smartphone + Login | On-the-go checking | 1–2 mins | Bill pay, biometric login |

| SMS Banking | Linked Phone | Quick access | <1 min | Works offline |

| ATM | Debit Card | Cash + balance | 2 mins | Mini-statement |

| Call Center | Phone | Human assistance | 5–7 mins | Multi-account info |

| Branch Visit | Physical presence | Complex queries | 10–20 mins | Printed statements |

Tips for Secure Balance Checking

- Always log out from online or mobile sessions.

- Never share your PIN, password, or OTP.

- Enable biometric login where available.

- Avoid using public Wi-Fi for banking transactions.

- Report suspicious messages or emails immediately.

Managing Multiple Accounts Efficiently

Many customers hold multiple accounts or credit cards. Performing a standard chartered bank balance check via online banking or the mobile app consolidates all accounts in one view. You can monitor balances, track spending, and schedule payments efficiently.

Also read: FAB balance check UAE – Step-by-step guide for details on managing FAB accounts in the UAE.

Common Issues During Balance Checks

- Login errors: Reset your password online or contact support.

- No SMS response: Ensure SMS banking is activated.

- ATM failure: Try another ATM or contact support.

- Mobile app issues: Update or reinstall the app.

Final Thoughts

A standard chartered bank balance check in the UAE has never been easier. With online banking, mobile apps, SMS, ATMs, call centers, and branch options, customers can access their account balances instantly, securely, and conveniently. Whether for personal finance management or business planning, these tools ensure you remain informed and in control of your money.

Also read: FAB balance check UAE – Step-by-step guide to learn how to manage your FAB account balances alongside Standard Chartered accounts.

By combining these balance check methods with security best practices and regular monitoring, you can maintain financial health in a fast-paced, UAE-centric banking environment.

FAQs About Standard Chartered Bank Balance Check UAE

- How can I check my Standard Chartered Bank balance online?

Log in to your online banking account and navigate to the “Accounts” section to view your balance. - Can I perform a balance check without internet?

Yes, SMS banking and ATMs allow balance checks without internet access. - How do I check my balance via the mobile app?

Open the SC Mobile UAE app, log in, and view your account balance on the home screen. - What is the SMS format for balance checking?

Send BAL <last 4 digits of account number> to +971 600 5222. - Is ATM balance checking free?

Standard Chartered ATMs are usually free. Fees may apply at other banks’ ATMs. - Can I check my credit card balance with these methods?

Yes, all methods support credit card balance checking. - How often should I check my balance?

At least once a week or before large transactions. - What should I do if my balance seems incorrect?

Contact Standard Chartered UAE customer service immediately. - Can I receive my balance via email?

Enable eStatements in online banking to get monthly summaries via email. - Is phone banking available 24/7?

Yes, Standard Chartered UAE provides round-the-clock phone banking for balance inquiries.