RAK Bank Credit Card

Overview

The RAK Bank Credit Card portfolio stands out as one of the most versatile and value-packed options for UAE residents. From cashback and travel benefits to lifestyle privileges and flexible payment options, RAK Bank offers credit cards that cater to every kind of spender — whether you’re a professional in Dubai, a family in Sharjah, or a frequent traveler based in Abu Dhabi.

In this article, we’ll explore everything about RAK Bank credit cards: their types, features, eligibility, online management, and how they fit into the evolving digital banking landscape of the UAE. With the bank’s commitment to innovation and customer-centric design, RAK Bank Credit Cards combine convenience with unbeatable rewards.

Read More on Uaebankbalance.com

The RAK Bank Credit Card Advantage

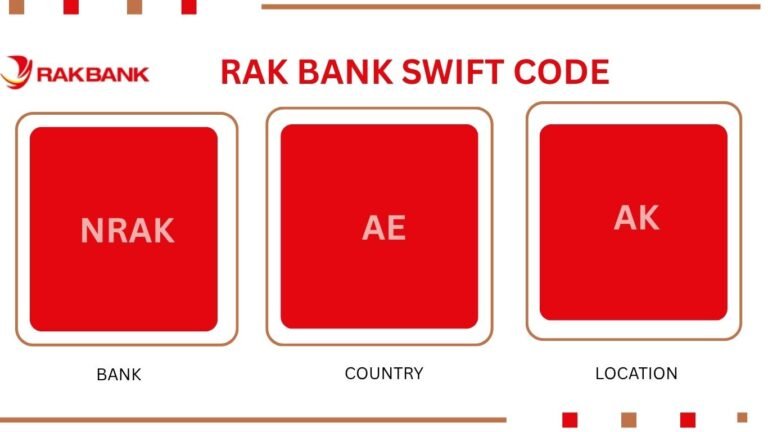

RAK Bank (National Bank of Ras Al Khaimah) has built its credit card lineup around flexibility and user benefit. Whether your goal is saving on everyday purchases, earning cashback, or maximizing travel perks, RAK Bank provides a card designed for your lifestyle.

With no hidden charges, transparent fee structures, and 24/7 online access, these cards are particularly popular among working professionals and expatriates. They integrate seamlessly with the RAKBANK Mobile App, allowing instant control — from balance checks to payment tracking — making financial management simple and efficient.

Moreover, RAK Bank’s partnerships with leading brands, airlines, and service providers ensure customers enjoy discounts and privileges across shopping, dining, and travel categories throughout the UAE and abroad.

Types of RAK Bank Credit Cards

RAK Bank offers a range of credit cards that suit various customer needs — from cashback lovers to frequent travelers and business owners. Let’s take a deeper look at each category

1. RAKBANK Titanium Credit Card

A favorite among UAE residents, the Titanium Card delivers up to 5% cashback on domestic and international spends, including supermarkets, dining, and utilities.

Key highlights:

- No annual fee

- Cashback automatically credited to your statement

- Complimentary access to airport lounges across the Middle East

- Free travel insurance and purchase protection

This card is ideal for everyday users who want steady returns without worrying about annual costs.

2. RAKBANK Emirates Skywards World Elite Mastercard

Perfect for frequent flyers, this premium credit card offers Skywards Miles for every dirham spent.

Key features include:

- Up to 2 Skywards Miles per USD spent

- Complimentary Emirates Skywards Silver tier membership

- Airport lounge access worldwide

- Free travel insurance and global concierge service

Whether traveling for business or leisure, this card provides unmatched travel luxury and savings.

3. RAKBANK HighFlyer Platinum Credit Card

Aimed at business professionals and entrepreneurs, the HighFlyer Card helps you earn HighFlyer Miles on both corporate and personal spending.

Benefits include:

- Redeemable points for flight tickets or hotel stays

- Business expense tracking tools

- Complimentary travel benefits

- Reward transfer flexibility to multiple airlines

It bridges the gap between business travel and lifestyle convenience — all under one platform.

4. RAKBANK Red Mastercard Credit Card

This lifestyle card is perfect for young professionals seeking affordability and control.

Key benefits:

- Low interest rate starting from 2.99%

- Cashback on groceries, fuel, and bill payments

- No annual fee (subject to minimum monthly spend)

- Instant online management via RAKBANK app

This card focuses on simplicity, transparency, and essential lifestyle rewards that suit daily UAE life.

5. RAKBANK World Credit Card

One of the most premium cards in the bank’s lineup, the World Credit Card offers luxury, flexibility, and global acceptance.

Benefits:

- LoungeKey access at 1,000+ airports

- Free multi-trip travel insurance

- Exclusive Mastercard World offers

- Concierge services and lifestyle privileges

It’s designed for those who value convenience, elite access, and global perks combined with local relevance.

Exclusive Benefits of RAK Bank Credit Cards

Each RAK Bank Credit Card is built around customer-centric features designed to make spending smarter and safer. Here’s what sets them apart:

1. Cashback and Rewards

Earn cashback or loyalty points on every transaction, redeemable for statement credit, travel bookings, or shopping vouchers.

2. Interest-Free Period

Up to 55 days of interest-free credit, giving you flexibility in managing cash flow while avoiding unnecessary interest charges.

3. Easy Installment Plans

Convert large purchases into 0% Easy Payment Plans (EPP) at leading UAE retailers and e-commerce stores.

4. Travel Privileges

Free travel insurance, access to global airport lounges, and reward points redeemable for flight upgrades or hotel bookings.

5. Fuel and Utility Savings

Earn rewards even on essential expenses like petrol, telecom, and electricity bills — something many UAE residents appreciate.

6. Security and Control

Instant card freezing, spending limits, and transaction alerts are accessible directly through RAKBANK Mobile Banking for maximum protection.

How to Apply for a RAK Bank Credit Card in the UAE

Applying for a RAK Bank Credit Card is quick and digital — no need for long paperwork or branch visits.

Application Process:

- Visit the official RAKBANK website or download the RAKBANK Mobile App.

- Choose your preferred credit card type.

- Fill out the application form with your Emirates ID and income details.

- Upload required documents: Emirates ID, passport, visa, and salary certificate.

- Receive instant approval (subject to eligibility and credit score).

In most cases, the physical card is delivered within a few working days, and online access can be activated immediately.

Eligibility Criteria for RAK Bank Credit Cards

While requirements may differ by card type, the general eligibility criteria are:

- UAE residency (Emirates ID mandatory)

- Minimum monthly income: AED 5,000 to AED 15,000, depending on the card

- Age: 21 years and above

- Valid UAE address and mobile number

- Clean credit history or acceptable score with AECB

RAK Bank also allows salary transfer customers to qualify for higher credit limits and additional benefits.

Online Management of RAK Bank Credit Cards

One of the most impressive aspects of RAK Bank’s credit cards is their full digital integration. Through the RAKBANK Mobile App or online portal, customers can:

- View statements and transactions in real time

- Set spending limits and control usage

- Pay outstanding balances instantly

- Report lost/stolen cards and request replacements

- Redeem cashback or travel points

- Convert large purchases to installments

This digital ecosystem means you’re in full control — whether managing your card from Dubai Marina, Al Ain, or Ras Al Khaimah.

Rewards and Loyalty Programs

RAK Bank’s rewards ecosystem is a key reason many UAE customers prefer its cards.

RAKBar Rewards: Earn points for every dirham spent using select RAK Bank Credit Cards. Points can be redeemed for vouchers, cashback, or travel miles.

Skywards Miles: For Emirates co-branded cards, every dollar spent earns Skywards Miles — perfect for those who travel frequently from Dubai or Abu Dhabi.

HighFlyer Miles: Designed for business and frequent travelers, redeemable for flights or upgrades with partner airlines.

These programs are flexible, transparent, and easy to manage online, without complicated redemption processes.

Fees and Charges Overview

RAK Bank is transparent about its charges.

Common details:

- Annual fees: Many cards offer first-year free or no annual fee forever.

- Interest rate: Starting from 2.99% per month.

- Late payment fee: Around AED 230.

- Foreign transaction fee: 2.5% to 3.0%.

- Cash advance fee: 3% or AED 99 minimum.

Customers are encouraged to pay full statements on time to avoid interest accumulation.

Security and Fraud Protection

Every RAK Bank Credit Card comes with cutting-edge security features:

- EMV chip technology for secure transactions

- Two-factor authentication for online payments

- Real-time SMS/email notifications for every spend

- 24/7 fraud monitoring system

The RAKBANK app also offers Card Control, allowing instant blocking, unblocking, or limit adjustments.

In addition, the bank partners with Mastercard SecureCode and Verified by Visa, providing an extra authentication layer for online purchases.

RAK Bank Credit Cards for Businesses

Business owners can also access Corporate Credit Cards, tailored for company expenses, travel, and vendor payments.

Features include:

- Centralized account management for multiple employees

- Customizable spending limits

- Integration with accounting software

- Travel and insurance benefits

These cards simplify expense tracking while offering corporate rewards, making them ideal for SMEs and startups in the UAE.

Why UAE Residents Prefer RAK Bank Credit Cards

RAK Bank’s reputation for customer-first banking and transparent pricing makes it one of the most trusted names in the UAE.

Top reasons for popularity:

- Multiple cards for different income brackets

- Quick approvals and minimal paperwork

- Generous cashback and reward options

- Wide acceptance across UAE retailers and international merchants

- Integration with RAKBANK’s digital platforms for real-time control

RAK Bank Credit Cards have become essential financial tools for individuals and businesses alike, combining reliability, convenience, and innovation.

Final Thoughts

The RAK Bank Credit Card range captures the essence of modern UAE banking — rewarding, digital, and designed around lifestyle convenience. Whether your goal is cashback savings, travel upgrades, or better financial flexibility, RAK Bank delivers products that balance value with trust.

With robust online management tools, strong security, and global acceptance, RAK Bank continues to set benchmarks for what a true UAE-focused credit card should offer. For residents looking to make every dirham count, RAK Bank Credit Cards represent a smart, future-ready choice.

Frequently Asked Questions (FAQ)

1. How do I apply for a RAK Bank Credit Card?

You can apply online through RAK Bank’s website or app, or visit any branch with your Emirates ID and proof of income.

2. What is the minimum salary for a RAK Bank Credit Card?

Most cards require a minimum salary between AED 5,000 and AED 15,000.

3. Does RAK Bank offer free credit cards?

Yes. Several RAK Bank cards, like the Titanium Credit Card, come with no annual fee.

4. How can I pay my credit card bill?

You can pay through online banking, mobile app, ATMs, or automatic salary deductions.

5. Is there travel insurance included?

Yes, premium cards include free multi-trip travel insurance and airport lounge access.

6. How secure are RAK Bank Credit Cards?

They come with chip-and-PIN protection, OTP verification, and fraud monitoring 24/7.