Mashreq Bank Swift Code

When money travels across borders, precision is everything. Just as an international traveler needs a passport, your money needs a digital identifier to find its way home. That identifier is the SWIFT code — the invisible key that ensures funds reach the right destination without delay. For millions of customers banking with Mashreq Bank, one of the UAE’s oldest and most innovative financial institutions, knowing the correct SWIFT code is essential for global transfers.

Read More: Want to manage your balances with other UAE banks? Explore our guides on ADCB UAE, Standard Chartered balance check, and FAB balance check for instant access to your account details.

Why the Mashreq Bank Swift Code is Crucial

The United Arab Emirates is a global crossroads — a financial hub connecting East and West, with Dubai at its beating heart. In such a landscape, international payments are routine. From expatriates sending remittances to corporate houses settling cross-border deals, accuracy matters.

The Mashreq Bank SWIFT code ensures:

- Correct routing of funds globally

- Fraud prevention through standardized identification

- Faster clearance across banking systems

- Trust and transparency in international dealings

Without the right code, payments risk being delayed, rejected, or misdirected — an avoidable headache in today’s fast-moving world.

What is a SWIFT Code, Really?

A SWIFT code — also known as a Bank Identifier Code (BIC) — is a globally recognized 8- or 11-character sequence. Think of it as the bank’s international DNA: unique, precise, and standardized.

It’s structured as follows:

- First 4 characters → Bank identifier (Mashreq Bank)

- Next 2 characters → Country code (AE for UAE)

- Next 2 characters → Location code (usually city or HQ)

- Last 3 characters (optional) → Specific branch code

For Mashreq Bank, this code is the bridge that links Dubai’s legacy of financial excellence with the global banking network of over 200 countries.

Mashreq Bank: A Legacy of Innovation

Established in 1967, Mashreq Bank holds the distinction of being the UAE’s oldest privately owned bank. Over the decades, it has been at the forefront of digital transformation, introducing many firsts: the country’s first ATM, first credit card, and first fully functional online banking platform.

Today, Mashreq blends tradition with technology, serving both retail and corporate clients. Its reach across global markets makes its SWIFT code not just relevant but indispensable for customers who live and operate in an international context.

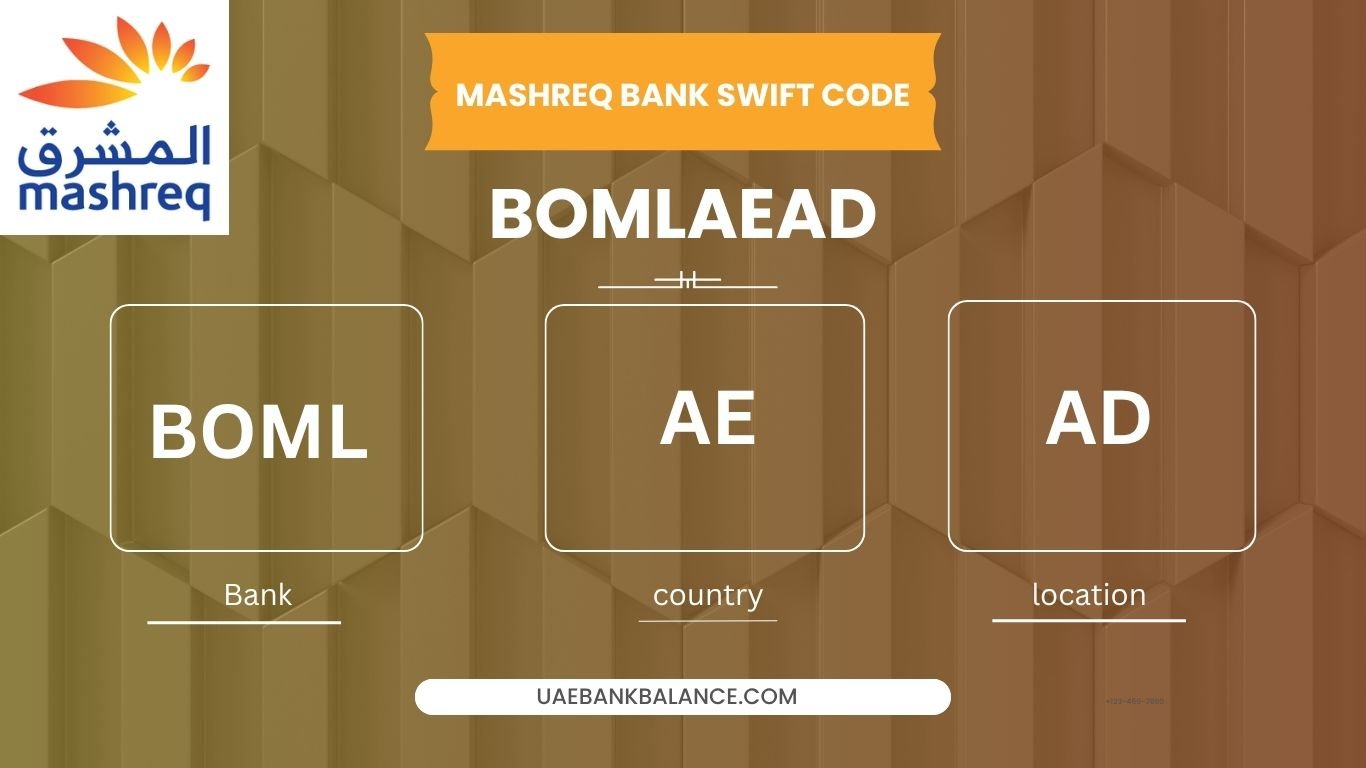

The Official Mashreq Bank SWIFT Code

The Mashreq Bank SWIFT code is:

BOMLAEAD

- BOML → Refers to Mashreq Bank

- AE → Indicates the United Arab Emirates

- AD → Specifies Dubai, the headquarters location

For transfers directed to specific branches, an extended 11-character SWIFT code may apply. Customers are always advised to confirm the exact code with their branch before processing large or recurring transfers.

When to Use the Mashreq Bank Swift Code

The Mashreq Bank SWIFT code is required whenever funds cross international borders. Typical scenarios include:

- Sending remittances to family abroad

- Receiving salary payments from overseas employers

- Settling international trade invoices

- Paying tuition fees to global universities

- Managing corporate investments across countries

In every case, the SWIFT code ensures the money goes to the right institution, reducing friction in an increasingly interconnected economy.

Mashreq Bank and Dubai’s Role as a Financial Gateway

Dubai has cemented its position as a regional financial powerhouse. With its blend of free zones, fintech incubators, and world-class regulatory environment, it attracts international capital like few other cities can.

Mashreq Bank plays a vital role in this story. As one of the UAE’s leading banks, it connects residents, businesses, and global investors. Its SWIFT-enabled channels empower the city’s role as a hub for cross-border trade, tourism, and investment.

SWIFT vs. IBAN: Clearing the Confusion

It’s common for customers to mix up SWIFT codes and IBANs. Both are essential, but they serve different purposes:

- SWIFT Code → Identifies the bank internationally

- IBAN → Identifies your individual account within that bank

In simple terms: the SWIFT code is the city address, and the IBAN is your house number. Both details together ensure your funds land exactly where intended.

How Mashreq Bank Facilitates International Transfers

Mashreq has invested heavily in building a digital-first banking infrastructure. Customers can initiate global transfers seamlessly through:

- Mashreq Online Banking

- Mashreq Mobile App

- Branch Services for larger corporate transactions

Features include:

- Real-time exchange rate transparency

- Lower transfer costs for preferred remittance corridors

- Tracking services via SWIFT gpi integration

- Automated SWIFT code entry to reduce user error

Shariah-Compliant and Conventional Services

Unlike purely Islamic banks, Mashreq Bank operates as a hybrid financial institution, offering both conventional and Shariah-compliant services. For international transfers, this dual structure means it caters to a wider base: traditional corporates, expatriates, and individuals seeking Islamic banking alternatives.

Security of Using Mashreq’s SWIFT Code

Every transfer routed through Mashreq’s SWIFT code benefits from robust layers of security and compliance. The bank uses:

- AI-powered fraud detection systems

- Multi-factor authentication protocols

- Encrypted communication channels with SWIFT

By entering the correct SWIFT code, customers ensure their transfers remain secure, compliant, and trackable.

Business Advantages of Mashreq Bank SWIFT Code

For businesses, especially those located in Dubai’s free zones, the Mashreq Bank SWIFT code is vital for:

- Paying global suppliers

- Receiving export payments

- Managing payroll for multinational teams

- Accessing trade finance solutions

With Dubai being one of the world’s busiest ports and aviation hubs, Mashreq ensures that global supply chains run smoothly through its SWIFT-enabled platforms.

Avoiding Common Errors

International transfers can be delayed due to simple mistakes. Here’s what customers should avoid:

- Using an incorrect SWIFT code

- Forgetting to add the IBAN

- Entering wrong beneficiary details

- Ignoring correspondent bank charges

Mashreq offers dedicated customer helplines, relationship managers, and digital FAQs to guide customers through smooth global transfers.

The Future of Cross-Border Transfers

The SWIFT system itself is evolving, with upgrades like SWIFT gpi that allow customers to track transfers in real-time. Mashreq Bank has already adopted these innovations, ensuring its clients enjoy faster, more transparent, and globally consistent services.

Dubai’s ambition to transition into a cashless economy by 2030 further reinforces Mashreq’s commitment to staying at the cutting edge of international finance.

FAQs on Mashreq Bank Swift Code

Q1: What is the Mashreq Bank SWIFT code?

The primary code is BOMLAEAD, representing Mashreq Bank’s headquarters in Dubai, UAE.

Q2: Is there a different SWIFT code for each branch?

The general code works for most transfers, but specific branches may have unique 11-character codes. Always verify with your branch.

Q3: How does SWIFT differ from IBAN?

SWIFT identifies the bank internationally, while IBAN specifies your account. Both are required for global transfers.

Q4: Can I transfer money abroad using Mashreq Mobile App?

Yes. The app allows you to initiate secure international transfers using the SWIFT code and your IBAN.

Q5: Is Mashreq Bank compliant with SWIFT gpi standards?

Yes. Mashreq has integrated SWIFT gpi, enabling faster, more transparent, and trackable transfers.

Q6: What happens if I enter the wrong SWIFT code?

Transfers may be delayed, rejected, or misdirected. Always double-check before confirming.

Q7: Does Mashreq Bank support both conventional and Islamic finance transfers?

Yes. Mashreq offers both conventional and Shariah-compliant services, catering to a wide range of customer needs.