Lulu ATM Balance Check

The Lulu Payroll Card and Lulu Prepaid Card are widely used across the UAE by thousands of workers who receive their salaries through the Wage Protection System (WPS). One of the most essential tasks for cardholders is performing a Lulu ATM balance check, which allows users to instantly see their available salary, remaining funds, and updated card balance.

This comprehensive guide provides everything you need to know about checking your Lulu card balance through ATMs, including step-by-step instructions, supported banks, fees, limits, troubleshooting, and answers to frequently asked questions.

- Lulu ATM balance check

- Lulu card balance check

- Lulu payroll card balance

- Lulu salary check

- Lulu balance inquiry

- WPS card balance check

Let’s explore every detail to help Lulu cardholders in the UAE manage their salary and card funds effortlessly.

Read More: FAB Balance Check

1. Understanding the Lulu Card System in the UAE

Before learning how to perform a Lulu ATM balance check, it’s important to understand the types of cards issued by Lulu Exchange and their features. Lulu Exchange has partnered with several UAE banks to provide payroll and prepaid card services, primarily for WPS salary distribution.

These cards fall under three main categories:

1. Lulu Payroll Card (WPS Card)

Issued to employees whose companies process salaries through Lulu Exchange. Salaries are automatically transferred to the card through the UAE Wage Protection System.

2. Lulu Prepaid Multi-Purpose Card

Used for:

- Shopping

- Online purchases

- Travel

- Daily expenses

3. Co-Partnered Bank Payroll Cards

These cards are issued through partner banks such as:

- ADCB

- FAB

- RAKBANK

Because these banks issue the cards, the balance can be checked on their ATMs or any UAE ATM network that supports the card.

2. What is Lulu ATM Balance Check?

A Lulu ATM balance check is the process of inserting your Lulu Payroll or Prepaid Card into any compatible ATM in the UAE to view your available balance. This includes:

- Current available salary

- Pending deposits

- Previous month’s balance

- ATM balance inquiry receipt

This method is popular because it is:

- Fast

- Secure

- Does not require internet

- Works 24/7

- Available at thousands of ATMs

For many workers who do not use mobile apps or online portals, ATM balance check remains the most reliable and accessible method.

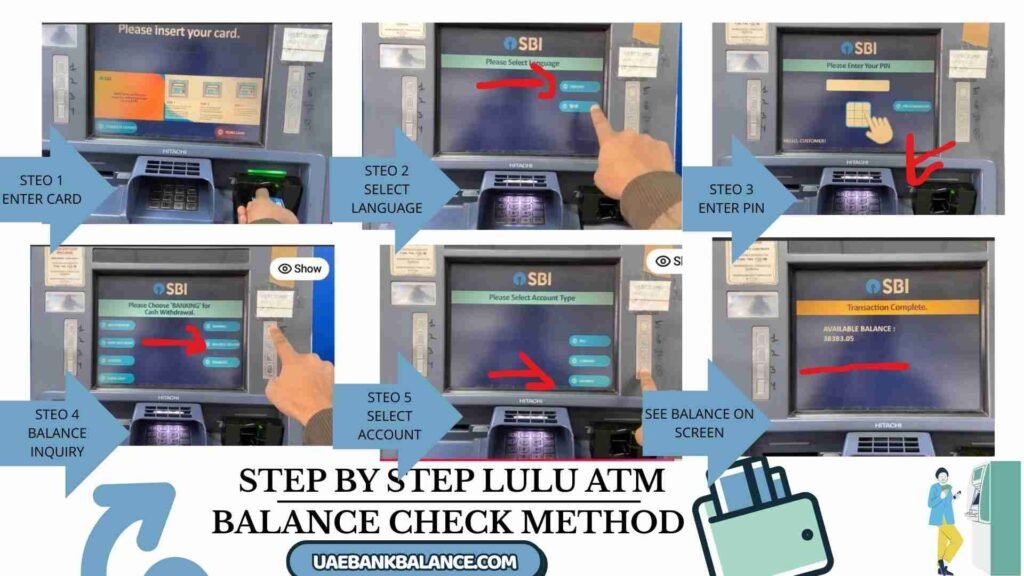

3. Step-by-Step Guide: How to Perform Lulu ATM Balance Check

Here is the exact process to follow when checking your balance at an ATM.

Step 1: Visit Any Compatible ATM

Look for ATMs that display Visa, Mastercard, or your card’s logo. Most Lulu Payroll Cards work with:

- ADCB ATMs

- FAB ATMs

- RAKBANK ATMs

- ENBD ATMs

- Mashreq ATMs

- NBAD / FAB ATMs

Step 2: Insert Your Lulu Card

Place the card in the ATM slot and wait for the system to load.

Step 3: Enter Your 4-Digit PIN

Do not share your PIN with anyone.

Entering incorrect PIN three times may block your card.

Step 4: Choose “Balance Inquiry”

On-screen options typically include:

- Withdraw Cash

- Balance Inquiry

- Mini Statement

- PIN Services

Choose “Balance Inquiry”.

Step 5: View Your Card Balance

Your available balance will be shown on the screen.

Step 6: Print a Receipt (Optional)

Some users prefer printed receipts for record keeping.

Step 7: Complete the Session

Take your card and receipt and ensure the session is closed fully.

This process takes less than one minute.

4. Banks That Support Lulu ATM Balance Check in the UAE

Lulu cards can be checked at ATMs of UAE banks that support your card’s payment network.

Here is a detailed table explaining compatibility:

Supported Banks for Lulu ATM Balance Check

| Bank Name | Compatibility | Balance Inquiry Fee | ATM Spread in UAE |

|---|---|---|---|

| ADCB | Highly compatible | Free or AED 1 | Very high |

| FAB (First Abu Dhabi Bank) | Compatible | AED 1 | Very high |

| RAKBANK | Compatible | AED 1 | Medium |

| ENBD | Partially compatible | AED 1–2 | Very high |

| Mashreq | Compatible | AED 1–2 | High |

| NBAD (now FAB) | Fully compatible | AED 1 | High |

| NBF | Partial | AED 1–2 | Medium |

| DIB | Some cards supported | AED 1–2 | High |

If your Lulu card is issued through ADCB, FAB, or RAKBANK, using their own ATM is the best option to reduce balance inquiry charges.

5. Lulu ATM Balance Check Charges and Fees

ATM fees vary based on the issuing bank and the ATM being used.

Balance Inquiry Fee Chart

| ATM Type | Expected Fee |

|---|---|

| ADCB ATM | Free or AED 1 |

| FAB ATM | AED 1 |

| RAKBANK ATM | AED 1 |

| Other UAE ATMs | AED 1–2 |

| International ATM | AED 3–10 |

Why Fees Vary?

- Employer agreement with the bank

- Card type (Payroll, Prepaid, WPS)

- ATM owner bank’s policy

Charges are deducted from your available balance automatically after the inquiry.

6. Checking Salary via Lulu ATM Balance Check

Most Lulu Payroll Card users perform ATM balance checks to verify whether their salary has been credited.

Salary Posting Times

| Salary Transfer Type | Expected Time |

|---|---|

| WPS System Salary | Same day or next day |

| Manual employer transfer | 24–48 hours |

| Public holiday transfer | Next business day |

If Salary Not Showing

Try these steps:

- Wait 2–3 hours

- Check again

- Contact HR

- Visit Lulu Exchange or issuing bank

7. Alternative Methods to Check Lulu Card Balance (Non-ATM Methods)

Although the keyword focus is Lulu ATM balance check, many users want other ways to check balances as well.

1. Online Portal Balance Check

Some cards allow checking balance through an online portal provided by:

- ADCB

- FAB

- RAKBANK

Users can log in using their card number or account details.

2. Mobile App Balance Check

Apps supporting Lulu cards include:

- Lulu Money App

- ADCB Mobile Banking App

- FAB Mobile App

- RAKBANK Mobile App

3. Lulu Exchange Branch Counter

Present your card and ID to check your balance instantly.

4. SMS Balance Inquiry

Some cards support SMS inquiry.

Not all cards include this service.

8. Common Problems During Lulu ATM Balance Check and How to Fix Them

Many users face issues when checking their balance at an ATM.

Here are the most common problems and solutions.

Problem 1: “Balance Not Available” Message

Causes:

- Salary not credited yet

- ATM network issues

- System undergoing maintenance

Solution: Try another ATM or wait 1–2 hours.

Problem 2: “Incorrect PIN”

Your card may get blocked if you try multiple times.

Solution: Visit Lulu Exchange to reset the PIN.

Problem 3: “Card Declined”

Causes:

- Expired card

- Damaged magnetic strip

- Chip malfunction

Solution: Replace the card at Lulu Exchange or the issuing bank.

Problem 4: ATM Not Accepting Card

Causes:

- ATM not supporting card network

- Technical error

Solution: Try ADCB, FAB, or RAKBANK ATMs first.

Problem 5: Salary Not Showing

Possible issues:

- Employer did not process payment

- WPS delay

- Bank processing delay

Solution: Contact HR or Lulu customer service.

9. Lulu Exchange Customer Care Support Details

If you face any issues with ATM balance checking, you can contact Lulu Exchange or the issuing bank.

Lulu Exchange Customer Support Numbers

| Service | Contact Number |

|---|---|

| Lulu Exchange Customer Care UAE | 600 522 204 |

| ADCB Payroll Support | 600 50 2030 |

| FAB Customer Support | 600 52 5500 |

| RAKBANK Support | 04 213 0000 |

10. Safety Tips When Performing ATM Balance Checks

Follow these tips to ensure safe transactions:

- Never share your PIN

- Stand close to the ATM

- Cover the keypad while entering PIN

- Avoid asking strangers for help

- Do not forget your card in the machine

- Always take your printed receipt

These practices protect your salary and personal information.

11. Frequently Asked Questions (FAQ)

Q1. How can I check my Lulu card salary at an ATM?

Insert your card → Enter PIN → Select “Balance Inquiry” → View balance.

Q2. Which ATM is best for Lulu ATM balance check?

ADCB, FAB, and RAKBANK ATMs provide the best compatibility.

Q3. Why is my salary not showing?

Employer delay, WPS processing, weekends, or public holidays.

Q4. Can I check Lulu card balance outside the UAE?

Yes, but international ATM fees apply.

Q5. Can I check my balance without an ATM?

Yes, through online portals, mobile apps, or Lulu Exchange counters.

12. Final Thoughts

The Lulu ATM balance check remains the fastest, most reliable, and most widely used method for employees in the UAE to confirm their salary and check their card balance. With compatibility across major UAE banks like ADCB, FAB, RAKBANK, and ENBD, users can check balances anytime and anywhere.

Whether you are a WPS worker, prepaid card user, or an employee receiving monthly salary through Lulu Exchange, knowing how to perform ATM balance checks ensures transparency, financial control, and peace of mind.