HSBC CDM UAE

In the UAE’s fast-paced financial environment, customers expect instant banking services without wasting time in branch queues. This is where the HSBC CDM (Cash Deposit Machine) becomes a core feature of modern banking. For residents, business owners, freelancers, and expatriates, the ability to deposit cash anytime, securely and directly into HSBC accounts, adds immense value. With HSBC’s digital ecosystem expanding, CDMs bridge the gap between physical banking and digital efficiency, ensuring your funds are processed quickly and safely.

These machines play an essential role in supporting the UAE’s economy, where both digital payments and cash transactions operate side by side. For many users, especially small business owners and individuals handling frequent cash deposits, HSBC CDMs deliver reliability, accessibility, and speed. Whether at a branch, mall, or office hub, HSBC CDMs are designed to give banking convenience without waiting for a teller or scheduling branch visits. As the UAE focuses on smart banking innovation, HSBC continues to enhance its CDM network to serve diverse financial needs across the country.

What Is an HSBC CDM?

An HSBC CDM is an automated self-service terminal that lets customers deposit cash into their HSBC accounts without visiting a counter. These machines are equipped with advanced counting and verification technology to ensure safe, accurate, and instant deposits. Unlike traditional ATMs that focus mainly on withdrawals, CDMs support direct cash deposit into personal, business, and corporate accounts, making them especially useful for individuals and companies with regular cash transactions. They function by securely validating currency notes and crediting funds into the account linked to your debit card or entered account number.

HSBC CDMs are designed to accept AED currency and provide printed receipts for every deposit for record-keeping and accuracy. With smart note-counting systems and anti-fraud detection built in, CDMs ensure secure deposit handling at all times. This makes them ideal for business cash drops, rent payments, credit card bill settlements, and day-to-day financial operations. For customers who prefer self-service banking, CDMs act as a reliable extension of the bank’s branch network.

Key Functions of HSBC CDM Machines

HSBC CDMs allow several important functions to support everyday financial needs. You can deposit cash directly into your personal HSBC account instantly, which is useful if you prefer cash management or receive payments in cash. Businesses can deposit earnings into corporate accounts daily or weekly, giving more control over working capital and cash flow. You can also deposit into HSBC credit cards, helping customers clear their balances quickly or avoid late fees. The machine prints a receipt for every transaction, ensuring transparency and security.

HSBC CDMs do not require deposit envelopes; instead, cash is scanned, counted, and confirmed before being processed. Some machines also support cardless deposits by entering the account number manually. These features reduce banking time, improve convenience, and strengthen financial planning for both individuals and organizations. Whether you manage salaries, business collections, personal savings, or emergency payments, HSBC CDMs streamline your deposit activity.

Where to Find HSBC CDM Locations in UAE

HSBC has strategically placed its CDMs in business hubs, malls, branch lobbies, and key commercial areas across Dubai, Abu Dhabi, and other emirates. Popular locations include branch premises, major office districts, and business-heavy areas such as Downtown Dubai, Dubai Marina, Abu Dhabi Corniche, and Sharjah city center. The easiest way to locate an HSBC CDM is by using the HSBC mobile banking app, which includes a locator for branches and self-service machines.

Customers can also search for HSBC CDM locations on the bank’s official website or through online maps. Many CDMs are available in mixed-use commercial buildings and public shopping destinations to serve high-traffic areas. Business customers benefit greatly from wide CDM accessibility in corporate zones. Locations are chosen to ensure maximum convenience for residents, professionals, and corporate clients who frequently handle cash.

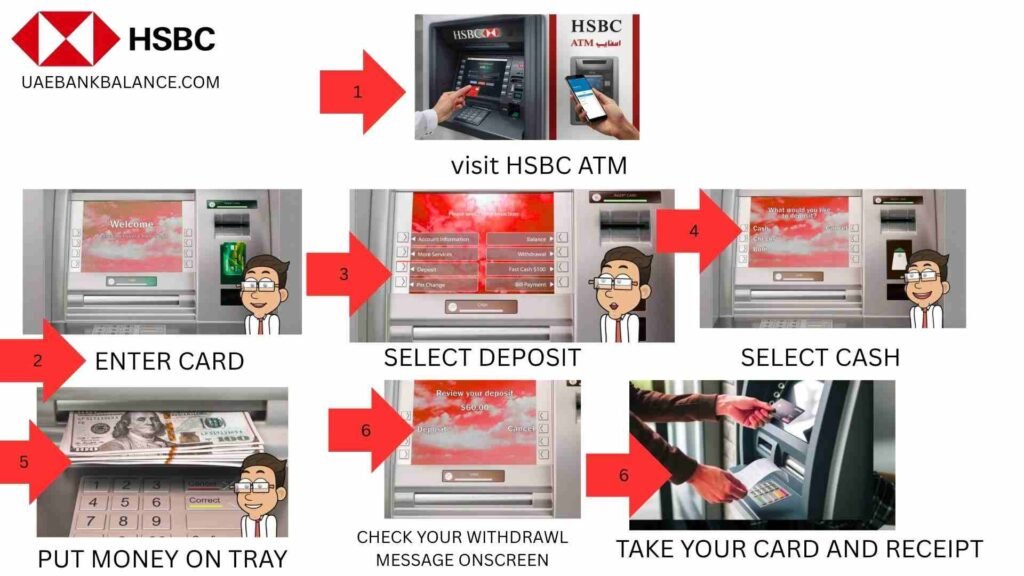

How to Use an HSBC CDM — Step-by-Step (H3 + Pointers)

Below is a clear, practical step-by-step process including short pointers for each action. Use these steps whenever you approach an HSBC CDM.

Step-by-Step Process (Quick Steps)

- Approach the machine and wake the screen: If the machine is idle, touch the screen or press any button to begin.

- Select language and service: Choose your preferred language and then select Cash Deposit (or Credit Card Payment if paying a card).

- Insert your card OR select cardless deposit:

- Card method: Insert your HSBC debit card and enter your PIN.

- Cardless method: Choose cardless deposit and manually enter the receiving account number.

- Prepare and insert notes: Align and flatten banknotes; insert them into the cash slot as prompted.

- Verify counted amount: The machine will count and display the total. Verify the amount on-screen.

- Confirm transaction: Press Confirm to process the deposit.

- Collect receipt: The CDM prints a receipt — keep it until you see the deposit reflected in your account.

- Complete follow-up if required: If the machine rejects notes or shows an error, follow the on-screen instructions and keep any interim slip.

Best Practices

- Prepare notes: remove paper bands, keep notes flat to reduce rejections.

- Small batch deposits: for large sums, split into multiple batches to avoid overload.

- Check machine status: locate adjacent signage that shows the CDM’s operational status.

- Retain receipts: always keep the printed receipt until the deposit posts in your app.

- Use off-peak hours: early morning or late evening often have shorter queues.

- Cardless deposits: ensure account numbers are accurate to avoid misposting.

Read more: Emirates NBD CDM and ADIB CDM

Deposit Limits & Processing Time (with Table)

HSBC CDM deposit rules vary by account type and machine. The table below summarises typical limits and processing expectations — use it as a quick reference.

| Item | Typical Value / Note |

|---|---|

| Currency accepted | AED only (most CDMs) |

| Minimum deposit | AED 10 |

| Per-transaction limit | Machine-dependent; often up to AED 50,000 |

| Daily limit | Depends on account type; higher for corporate clients |

| Processing time | Usually immediate (real-time posting), up to a few minutes |

| Cheque acceptance | Not on all machines — branch or cheque-drop needed |

| Receipt | Printed instantly; required for disputes |

Deposits are credited to accounts in real time in most cases. If a deposit appears pending, check the receipt and contact HSBC support with the transaction reference.

Features That Make HSBC CDMs Secure and Reliable

Security is a critical component of HSBC’s banking ecosystem, and CDMs are equipped with advanced technology to ensure safe transactions. Machines use note-authentication systems to detect counterfeit currency and prevent fraud. Encrypted banking communication ensures the data you enter stays private and secure. Surveillance cameras and machine sensors add another layer of protection at physical locations.

You also receive immediate receipts and account notifications for transparency. Combined with HSBC’s strong cybersecurity infrastructure, CDMs provide peace of mind for individuals and businesses. The machines undergo routine maintenance and monitoring to ensure they function efficiently. HSBC’s global security protocols apply to every UAE machine, reinforcing consistent safety standards.

Advantages of HSBC CDM Banking in the UAE

The biggest advantage is 24-hour access at many locations, offering flexibility for busy professionals and businesses. CDMs help avoid branch queues, saving time and allowing faster banking, especially during salary periods and peak hours. They support business continuity for merchants who deposit cash daily and require immediate account credit. Instant posting ensures smooth transaction history management and immediate fund availability. CDMs enhance digital banking by complementing mobile app and online services. They allow you to manage funds conveniently, making them ideal for freelancers, SMEs, and salaried individuals alike. The combination of speed, convenience, and secure processing makes HSBC CDMs a core part of modern financial services in the UAE.

Difference Between HSBC CDMs and ATMs (H3 + Table)

Although ATMs and CDMs may look similar, they serve different purposes. The following table highlights the differences so you can choose the right machine for your need.

| Feature | ATM | CDM |

|---|---|---|

| Primary purpose | Withdrawals, balance checks | Cash deposits, credit card payments |

| Deposit envelope | No | No (machine scans notes directly) |

| Cheque deposit | Some ATMs | Rare — usually branch |

| Receipt | Yes | Yes (detailed deposit receipt) |

| Real-time posting | Depends | Usually immediate |

| Cardless deposit | Limited | Often supported |

Knowing the difference helps you avoid confusion and saves time.

Tips for Smooth HSBC CDM Use

- Organize notes by denomination before inserting them.

- Avoid damaged, wet, or extensively folded notes; machines may reject these.

- Always wait for the final confirmation screen and collect your receipt.

- If the machine returns notes or shows an error, keep any interim slip and contact HSBC customer care.

- For high-volume business deposits, use scheduled off-peak times or multiple deposit machines if available.

- Keep your mobile banking app notifications enabled to confirm that deposits have posted.

When to Visit a Branch Instead of Using a CDM

While CDMs offer convenience, certain banking activities require branch visits. If you are depositing cheques, opening or closing accounts, requesting certified statements, or handling large business-level banking inquiries, visiting a branch remains ideal. HSBC branches in the UAE are equipped with dedicated business desks for corporate clients, wealth centers for premier customers, and general banking counters for everyday services. In special cases such as disputed deposits or rejected notes, branch support ensures resolution. CDMs are a strong complement, not a full replacement, for branch banking services.

Business and Corporate Use of HSBC CDMs in the UAE

For corporate and SME clients, CDMs play a vital role in daily operations. Retailers, hospitality businesses, service providers, freelancers, and traders often collect cash from customers, and safe evening or weekend deposit options reduce cash-holding risks. Daily deposits support inventory cycles, supplier payments, and payroll management by ensuring funds remain liquid and accessible. HSBC provides business users with enhanced deposit support through linked corporate cards that allow staff to deposit cash on behalf of their company. Receipt printing and instant confirmations allow finance teams to reconcile funds accurately. Additionally, organizations with international remittance needs can deposit funds domestically and transfer them globally through HSBCnet and global banking channels, strengthening cross-border financial flows.

CDMs help maintain transparency in accounting, create clear audit trails via receipts and digital logs, and ensure better financial compliance. Because cash remains a major transaction mode in the UAE—especially for small merchants and trade sectors—HSBC CDMs provide a reliable bridge between physical banking and digital treasury tools.

FAQs About HSBC CDM Banking

What is an HSBC CDM?

It is a machine that allows cash deposit directly into HSBC accounts without a teller.

Can I deposit into my HSBC credit card?

Yes, CDMs support credit card cash deposits for instant payments.

Is the deposit reflected instantly?

Usually yes, though small system delays can occur.

Do CDMs accept coins or cheques?

CDMs generally accept only paper currency. Cheque acceptance varies by machine and location; for cheque deposits, visit a branch.

Can businesses use CDMs for employee deposits?

Yes, corporate and SME customers frequently rely on CDMs for routine cash handling.

What should I do if the CDM rejects notes?

Keep the transaction slip, do not leave the machine until you have confirmation, and contact HSBC support with the receipt and machine reference.

Conclusion

HSBC CDMs in the UAE provide convenient, secure, and fast banking access for individuals and businesses alike. They support real-time deposits, operating as a bridge between traditional branch banking and modern digital convenience. With 24-hour availability in key locations and smart features integrated into HSBC’s secure ecosystem, these machines empower users with control, speed, and efficiency. As UAE banking evolves, HSBC’s CDM network ensures that customers enjoy a seamless experience supported by strong infrastructure, reliable technology, and user-friendly services.