FAB e-Dirham Card Balance Check – UAE Guide

Introduction:

Digital Payments Revolution in the UAE

In the UAE, financial transactions are moving faster than ever. With the rise of digital payments, FAB e-Dirham cards have become a cornerstone for residents and businesses alike. Whether it’s paying for government services, shopping, or online utilities, the eDirham card provides a secure, efficient, and widely accepted solution.

Understanding your FAB e-Dirham card balance is critical. It empowers users to manage budgets, plan payments, and avoid transaction failures in a digital-first economy. In a nation driving toward cashless services, knowing your balance isn’t just convenient—it’s essential.

What is the FAB e-Dirham Card?

The FAB e Dirham card is a prepaid card issued by First Abu Dhabi Bank, specifically designed for transactions across government portals and select commercial platforms in the UAE. Unlike traditional debit or credit cards, it requires preloaded funds, allowing for controlled and predictable spending.

Key Features

- Prepaid Functionality: Load only what you plan to spend, avoiding overdrafts.

- Government Payments: Widely accepted for official services, fines, visas, and fees.

- Secure Transactions: Enhanced security features protect every transaction.

- Budget Management: Ideal for both personal and organizational finance planning.

With these capabilities, the FAB e Dirham card aligns seamlessly with the UAE’s vision for digital financial infrastructure.

How to Check FAB e Dirham Card Balance

FAB ensures multiple convenient channels for checking e Dirham balances, catering to different user preferences and accessibility needs.

1. Online Banking Portal

Access your FAB account through the official online banking portal. Once logged in, users can instantly view eDirham card balances, transaction history, and even manage multiple cards from a single dashboard.

2. FAB Mobile App

The FAB Mobile App provides real-time balance checks with biometric login options. Users can monitor spending, receive notifications, and manage top-ups from anywhere in the UAE.

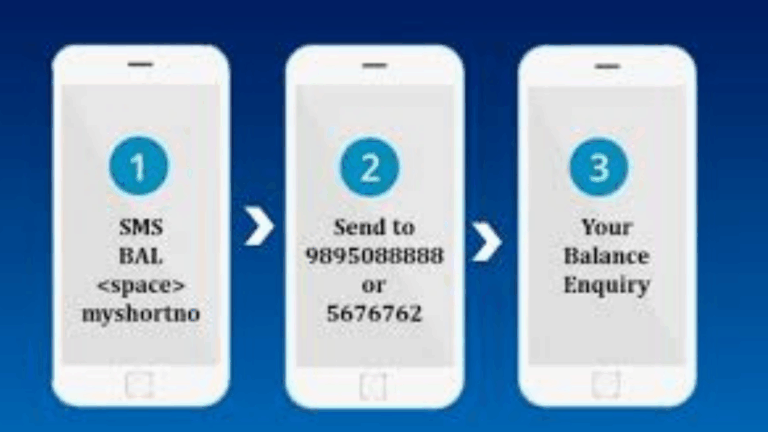

3. SMS Banking

For those without reliable internet access, SMS banking offers a quick alternative. Sending a preformatted text message to FAB’s SMS service returns your eDirham card balance in seconds—a convenient tool for field employees, travelers, or expatriates.

4. ATM and Customer Support

FAB ATMs across the UAE also provide balance information for eDirham cards. Additionally, customer service representatives are available for phone inquiries, ensuring immediate resolution for balance or transaction issues.

Benefits of Regular Balance Checks

Regularly monitoring your FAB e Dirham card balance offers multiple advantages:

- Prevent Transaction Failures: Avoid declined payments when funds are insufficient.

- Manage Budgets: Track government fees, fines, and other recurring expenses.

- Plan Payments Efficiently: Know exactly how much you can spend without interruptions.

- Track Spending Patterns: Identify and adjust recurring payments or unexpected charges.

By maintaining visibility over your e Dirham balance, you gain control and peace of mind, ensuring smooth transactions across the UAE’s digital landscape.

Security Features

FAB prioritizes user security across all e Dirham card access methods:

- Data Encryption: Protects transaction data from unauthorized access.

- Two-Factor Authentication: Ensures safe login for online and mobile platforms.

- Fraud Monitoring: Detects suspicious activity in real-time.

- Biometric Verification: Fingerprint or facial recognition for mobile app users.

These measures safeguard users while supporting the UAE’s move toward secure cashless payment systems.

Practical Use Cases Across the UAE

The FAB e Dirham card is widely used across various sectors:

- Government Services: Pay for visas, fines, and permits without visiting service centers.

- Retail & Commercial Transactions: Accepted at partnered businesses for hassle-free payments.

- Corporate Payroll or Allowances: Companies can distribute prepaid amounts for staff use.

- Expatriate Residents: Simplifies budget management and digital payments across UAE cities.

Its versatility ensures that both individuals and organizations can benefit from streamlined digital transactions.

Tips for Efficient e Dirham Balance Management

- Enable Mobile Notifications: Receive instant alerts for card activity.

- Monitor Transaction History: Keep track of spending and detect unusual charges.

- Top-Up Strategically: Add funds based on anticipated needs.

- Set Spending Limits: Protect your funds for essential expenses.

- Use SMS Banking as Backup: Ensure access even without an internet connection.

Economic and Cultural Relevance

The FAB e-Dirham card aligns with the UAE’s digital transformation strategy. It supports the country’s vision of reducing cash dependency while enhancing efficiency in public and private financial services. Residents benefit from secure, transparent transactions, while expatriates can navigate payments seamlessly without requiring physical cash.

Future Outlook for Prepaid Government Cards in the UAE

The UAE’s digital economy is continuously evolving. Prepaid cards like the FAB e Dirham are expected to adopt:

- AI-Based Insights: Personalized spending analysis and recommendations.

- Predictive Alerts: Notifications for low balance, service renewals, or pending fees.

- Integrated Digital Wallets: Combining multiple government and commercial payments into a single interface.

These enhancements will further simplify balance management, making online and mobile balance checks an essential part of UAE life.

Why FAB e Dirham Card Stands Out

- Multiple Access Channels: Online portal, mobile app, SMS, and ATMs.

- Enhanced Security: Protects funds and personal data.

- User-Centric Design: Optimized for residents, expatriates, and businesses.

- Aligned with the UAE’s Digital Vision: Supports cashless transactions across sectors.

With these benefits, the FAB e Dirham card is a reliable, modern solution for digital payment management in the UAE.

Frequently Asked Questions (FAQ)

1. How can I check my FAB e Dirham card balance online?

You can check via the FAB Mobile App, online banking portal, SMS service, or ATMs.

2. Is online balance checking safe?

Yes. FAB uses encryption, biometric login, and real-time fraud monitoring.

3. Can I access my balance without the internet?

Yes, SMS banking or contacting customer support provides immediate balance information.

4. Will checking the balance affect my credit score?

No, prepaid card balance inquiries do not impact credit scores.

5. Can I set alerts for a low balance?

Yes, enable notifications in the FAB Mobile App to receive alerts.

6. Can businesses monitor multiple e Dirham cards?

Yes, corporate accounts allow tracking multiple prepaid cards for employees or departments.7. What should I do if the balance seems incorrect?

Contact FAB customer support immediately to resolve discrepancies.