FAB Cashback Card UAE – Benefits, Movie Offers, Lounge Access & Full Guide

In the UAE, credit cards are no longer just payment tools. They’ve evolved into lifestyle companions—covering groceries, fuel, dining, travel, entertainment, and even airport experiences. Among the many options available, the FAB Cashback Card stands out for one simple reason: it rewards everyday spending in a way that feels immediate, practical, and relevant to life in the UAE.

Whether you’re filling your car with fuel, ordering food, booking movie tickets, or traveling through Dubai or Abu Dhabi airports, the FAB Cashback Card UAE is designed to give something back—literally.

This comprehensive guide explores FAB Cashback Card benefits, movie offers, lounge access, airport transfers, fees, terms and conditions, and everything UAE residents want to know before applying.

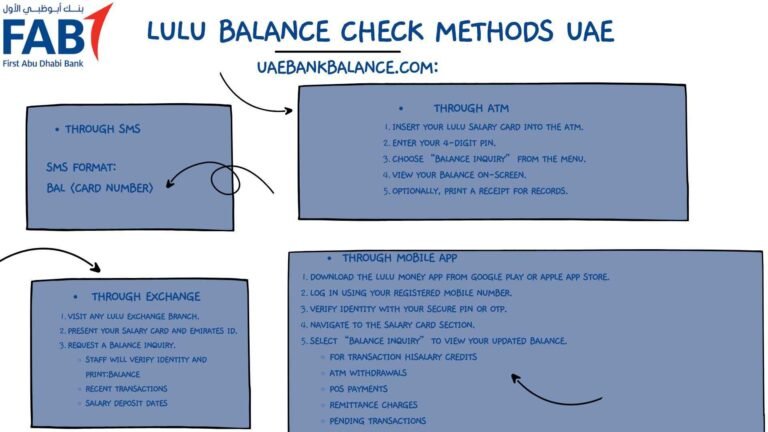

Read More: FAB Balance Check

What Is the FAB Cashback Card?

The FAB Cashback Card is a popular credit card offered by First Abu Dhabi Bank, tailored specifically for UAE residents who prefer straightforward rewards instead of complicated points systems.

Rather than converting points or miles, this card offers direct cashback credited to your account, making it one of the most transparent cashback cards in the UAE market.

It is especially popular among:

- Salaried professionals

- Families with regular household spending

- UAE residents looking for simple, everyday rewards

- Movie lovers and frequent mall visitors

Why the FAB Cashback Card Is Popular in the UAE

The UAE has a high cost-of-living structure combined with frequent lifestyle spending—fuel, dining, entertainment, and travel. The FAB Cashback Card UAE benefits align perfectly with these habits.

What makes it appealing is that the rewards are:

- Easy to understand

- Automatically credited

- Useful for daily expenses

- Not limited to luxury spending

This practicality is why it consistently ranks among the most searched cashback cards in the UAE.

FAB Cashback Card Benefits UAE: What You Really Get

The heart of this card lies in its cashback structure.

Everyday Cashback Advantages

Cardholders earn cashback on:

- Supermarket purchases

- Fuel spending

- Dining and food delivery

- Online and retail shopping

Cashback is typically credited monthly, reducing your outstanding balance directly.

These FAB cashback card benefits UAE make it especially attractive for residents managing regular monthly expenses.

FAB Cashback Card Movie Offers & Movie Tickets

Entertainment is a major spending category in the UAE, and FAB has leaned into this trend.

FAB Cashback Card Movie Offers

Cardholders enjoy:

- Discounted movie tickets

- Buy-one-get-one offers (at select cinemas)

- Cashback on ticket purchases

FAB Cashback Card Movie Tickets

You can often book movie tickets using:

- Online cinema platforms

- Mall cinema counters

These benefits are particularly popular in cities like Dubai, Abu Dhabi, and Sharjah, where cinema culture is strong.

FAB Cashback Card Airport Lounge Access

Travel perks are no longer reserved for premium cards. The FAB Cashback Card lounge access feature adds real value for frequent flyers.

Airport Lounge Access Benefits

- Complimentary lounge access at select airports

- Comfortable seating, refreshments, Wi-Fi

- Reduced travel stress during layovers

This FAB cashback card airport lounge access is especially useful for UAE residents who travel regionally or internationally multiple times a year.

FAB Cashback Card Free Airport Transfer

One of the lesser-known yet highly valued perks is the FAB cashback card free airport transfer benefit.

Depending on promotions and usage:

- Cardholders may receive complimentary airport transfers

- Available for selected rides or partner services

- Often linked to spending thresholds

This feature adds convenience and cost savings, particularly for Dubai and Abu Dhabi airport travel.

FAB Cashback Card Free for Life: Is It Really?

A common question among applicants is whether the FAB Cashback Card is free for life.

FAB Cashback Card Annual Fee

- The card usually comes with an annual fee

- However, annual fee waivers are often offered:

- In the first year

- Or permanently, based on minimum spend

So while not automatically free forever, many cardholders effectively enjoy the FAB cashback card free for life through consistent usage.

FAB Cashback Card Annual Fee Explained

Understanding fees is crucial.

Typical Annual Fee Structure

- Standard annual fee applies

- Waived in the first year (common promotion)

- Subsequent waiver possible with minimum spend

Always review the FAB cashback card terms and conditions to confirm current offers.

FAB Cashback Card Terms and Conditions

The FAB cashback card terms and conditions outline how rewards and benefits apply.

Key areas include:

- Cashback percentage caps

- Eligible spending categories

- Monthly cashback limits

- Lounge access usage limits

- Airport transfer eligibility

- Payment deadlines and interest charges

Reading these terms helps avoid surprises and ensures you maximize benefits.

FAB Cashback Card Lounge Access vs Premium Cards

While premium cards offer unlimited lounge access, the FAB cashback card lounge access focuses on:

- Practical access

- Fewer restrictions

- Easy qualification

For everyday users, this balance between cost and benefit is often more appealing than premium alternatives.

FAB Cashback Card UAE Benefits for Families

Families benefit significantly from this card due to:

- Cashback on groceries

- Dining rewards

- Entertainment discounts

- Fuel savings

These FAB cashback card UAE benefits translate into real monthly savings, especially for households managing recurring expenses.

Who Should Apply for the FAB Cashback Card?

This card is ideal if you:

- Prefer cashback over points

- Spend regularly on groceries, fuel, and dining

- Enjoy movies and mall entertainment

- Travel occasionally and value lounge access

- Want a card with manageable fees

It may not be ideal for those seeking airline miles or luxury hotel privileges.

Digital Banking & Card Management

The FAB Mobile App allows cardholders to:

- Track cashback earnings

- Monitor transactions

- Pay credit card bills

- Control spending limits

- View offers and promotions

This digital integration enhances the overall card experience.

How FAB Cashback Card Compares in the UAE Market

Compared to other cashback cards, FAB’s offering stands out for:

- Clear cashback structure

- Entertainment-focused rewards

- Airport perks without premium fees

- Strong acceptance across the UAE

It strikes a balance between simplicity and lifestyle benefits.

Final Thoughts

The FAB Cashback Card UAE is designed for real life—not just luxury spending. From everyday groceries and fuel to movie tickets, lounge access, and airport transfers, it rewards habits most UAE residents already have.

If you’re looking for a credit card that delivers consistent value, transparent rewards, and lifestyle perks without complexity, the FAB Cashback Card remains one of the strongest contenders in the UAE market.

For readers of UAEBANKBALANCE.COM, this card represents a smart blend of savings, convenience, and modern banking benefits.

Frequently Asked Questions (FAQs)

What are the main FAB cashback card benefits?

Cashback on groceries, fuel, dining, shopping, movie offers, and travel perks.

Does the FAB cashback card offer movie discounts?

Yes, it includes movie offers and discounted movie tickets at selected cinemas.

Is FAB cashback card free for life?

The annual fee is often waived, especially in the first year or with minimum spending.

Does FAB cashback card include airport lounge access?

Yes, complimentary lounge access is included at selected airports.

Is there free airport transfer with FAB cashback card?

Yes, free airport transfers are available under certain conditions.

What is the FAB cashback card annual fee?

It varies but is often waived through promotions or spend requirements.

Where can I use FAB cashback card in the UAE?

The card is widely accepted across retail, dining, online platforms, cinemas, and travel services.