FAB Bank Cards

Managing money in the UAE has become easier than ever with FAB Bank Cards. From everyday payments to international travel, First Abu Dhabi Bank (FAB) offers a range of cards designed to fit different lifestyles and financial needs. Whether you want a prepaid card for salary use, a credit card for rewards, or a debit card linked to your account — FAB has something for everyone.

This article covers everything you need to know about FAB Bank Cards, including how to apply, activate, and check your card balance. You’ll also learn about FAB Bank Credit Cards, FAB Bank Prepaid Card Inquiry, and the FAB Bank Card Inquiry process — all tailored for customers across the UAE.

Understanding FAB Bank Cards

FAB Bank, one of the UAE’s largest and most trusted banks, offers multiple card types that suit individuals, professionals, and businesses. Each card type comes with unique benefits and features designed to simplify payments and financial management.

FAB’s range of cards includes:

- FAB Bank Debit Card – For everyday purchases and ATM withdrawals.

- FAB Bank Credit Card – For shopping, rewards, and travel perks.

- FAB Bank Prepaid Card – Often used as a salary or Ratibi card.

- FAB Bank Salary Card (Ratibi) – A prepaid card for employees who don’t have a bank account.

These cards can be used across the UAE and globally, giving customers flexibility and security in all their transactions.

FAB Bank Debit Card: Everyday Convenience

The FAB Bank Debit Card is one of the most widely used cards among account holders in the UAE. It’s directly linked to your FAB savings or current account, allowing you to withdraw money, make payments, and shop online or in stores.

FAB debit cards work on major global networks like Visa and Mastercard, ensuring worldwide acceptance. You can also use your debit card for:

- ATM withdrawals in UAE and abroad

- Contactless payments using your smartphone

- Online transactions on UAE and international websites

- Automatic bill payments for utilities and telecoms

The debit card also connects to the FAB Mobile App, where you can view transactions, check balance, or temporarily block the card if needed.

FAB Bank Credit Card: Rewards and Lifestyle Benefits

FAB’s credit cards are designed for UAE residents who want flexibility, rewards, and exclusive benefits. Whether you’re a frequent traveler, a shopping lover, or someone looking for cashback offers, FAB has a credit card tailored to you.

Some popular FAB credit cards include:

- FAB Platinum Credit Card – Offers cashback on dining, groceries, and travel.

- FAB Infinite Credit Card – Comes with luxury travel benefits and lounge access.

- FAB Cashback Credit Card – Provides high cashback rates on daily purchases.

- FAB Islamic Credit Card – Sharia-compliant option for customers preferring Islamic banking.

Credit cards from FAB come with easy installment plans, online account management, and 24/7 customer support. Customers can apply online or visit a FAB branch in UAE for personalized assistance.

FAB Bank Prepaid Card: Simple and Secure

The FAB Prepaid Card is perfect for customers who want control over their spending. Unlike a credit or debit card, a prepaid card isn’t linked to your bank account. You load money onto the card and spend only what’s available.

Popular FAB Prepaid Cards in UAE

- FAB Ratibi Card – A salary card given by employers to workers who don’t have bank accounts. It allows easy salary withdrawals from ATMs and can be used for purchases.

- FAB Travel Prepaid Card – Ideal for travelers who want to manage foreign currency spending abroad.

- FAB Gift Card – Can be used for online or in-store purchases across UAE.

Prepaid cards are especially popular among employees and students who want to avoid overspending while enjoying card-based payments.

FAB Bank Card Inquiry: How to Check Your Card Details

You can easily perform a FAB Bank Card Inquiry using multiple methods. This helps you track your card’s balance, recent transactions, and expiry information.

1. Through FAB Mobile App

Log in to your FAB Mobile Banking App using your credentials. From the main dashboard, you can check your card balance, transaction history, and available credit limit.

2. Via Online Banking

Visit the official FAB Online Banking portal and log in to your account. Select your card type — debit, credit, or prepaid — to view detailed statements.

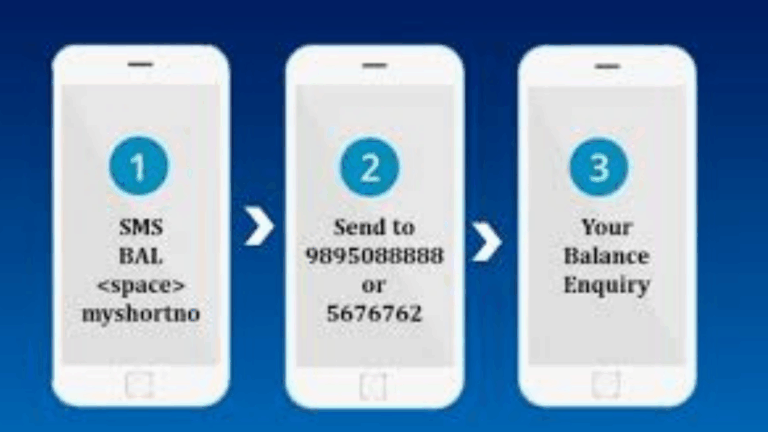

3. Using SMS or ATM

FAB also allows customers to check balance through ATMs or SMS services (for Ratibi and prepaid cards). Insert your card into an ATM, choose “Balance Inquiry,” and follow the on-screen instructions.

4. In-Branch Card Inquiry

If you prefer in-person assistance, you can visit any FAB branch across the UAE. The bank staff can help you with card details, reissue, or balance inquiries.

FAB Bank Prepaid Card Inquiry: Ratibi and Salary Cards

For FAB Ratibi cardholders, checking your balance is simple. You can:

- Visit the Ratibi Card Balance Inquiry page on the FAB website.

- Enter the last two digits of your card and your card number.

- View your available balance instantly.

Alternatively, Ratibi users can check their balance at any FAB ATM in UAE.

This service is free, and you don’t need a FAB account to use the Ratibi card — making it ideal for employees and laborers receiving wages through the WPS (Wage Protection System).

FAB Bank Card Activation and Replacement

After receiving your FAB card, activation is the first step to start using it.

How to Activate FAB Bank Card

You can activate your card by:

- Logging into the FAB Mobile App and selecting “Activate Card.”

- Calling the FAB customer care number (600 52 5500).

- Visiting a nearby FAB ATM and entering your card PIN for first-time use.

If your card is lost or expired, FAB allows easy replacement requests online or at any FAB branch in UAE. Replacement cards are usually issued within 2–3 working days.

FAB Bank Card Balance Check

Checking your FAB card balance helps you stay updated on your finances. You can check your balance through:

- FAB Mobile App – Real-time balance updates for debit, credit, or prepaid cards.

- ATM Machines – Insert your card and select “Balance Inquiry.”

- Online Banking Portal – Check balances, view transactions, and download statements.

- Customer Support – Call FAB’s helpline to inquire about your balance directly.

FAB Bank Credit Card Features and Offers

FAB’s credit cards come with unmatched benefits designed for UAE customers. Some of the key features include:

- Up to 5% cashback on dining, shopping, and fuel.

- Complimentary airport lounge access across major cities.

- Balance transfer options with low-interest rates.

- Flexible installment payments for large purchases.

- Reward points that can be redeemed for flights, hotel stays, or gift vouchers.

FAB also frequently runs promotions for its credit card customers — such as travel discounts, hotel deals, and dining rewards with partner restaurants.

FAB Bank Ratibi Card Benefits

The FAB Ratibi Card is one of the most recognized prepaid salary cards in the UAE. It’s commonly issued by employers for workers who don’t have traditional bank accounts.

Key benefits include:

- No minimum balance requirement

- Free salary withdrawal at FAB ATMs

- Safe and convenient alternative to cash payments

- Accepted at stores and online platforms

- 24/7 balance check via FAB’s Ratibi portal

The card is widely used by UAE companies for their employees’ salary disbursements under the WPS system.

Physical Method: Visiting a FAB Branch to Get a Card

If you prefer in-person banking, FAB provides a smooth process for card applications and inquiries at all its UAE branches.

To apply or activate your card physically, simply visit the nearest FAB Bank branch with your Emirates ID, passport copy, and any additional documents (depending on your card type). A customer representative will guide you through:

- Submitting the application form

- Providing KYC documents

- Setting up your PIN

- Activating or replacing your card

Branches in major areas like Abu Dhabi, Dubai, Sharjah, and Al Ain are open throughout the week with extended working hours for your convenience.

FAB Digital Banking and Card Management

FAB’s mobile and online banking systems allow full control of your cards anytime, anywhere. Through the FAB App, you can:

- Freeze or unfreeze your card

- Change PIN instantly

- View and download e-statements

- Set transaction limits

- Enable or disable international usage

The bank’s advanced digital tools ensure safety and flexibility, making it easier for UAE residents to manage all card activities securely.

FAB Bank Card Customer Care in UAE

If you face issues with your FAB card, such as blocked transactions or lost cards, customer care is always available.

- Call: 600 52 5500 (available 24/7)

- Visit: Any FAB branch for personal assistance

- Online: Use the FAB “Contact Us” form for inquiries

FAB’s multilingual support team helps customers across the UAE with quick resolutions for card inquiries, replacements, or activation issues.

Conclusion: Why FAB Bank Cards Are Perfect for UAE Residents

Whether it’s a credit card for lifestyle rewards, a debit card for everyday spending, or a prepaid Ratibi card for salary use, FAB Bank provides reliable and modern card solutions for everyone in the UAE.

FAB’s combination of secure technology, customer service, and flexibility makes it one of the most trusted banking choices in the Emirates.

With features like easy card inquiry, digital balance checks, and branch support across the UAE, managing your FAB Bank Cards has never been simpler.

FAQ

1. How can I check my FAB Bank card balance online?

You can check your balance using the FAB Mobile App, online banking portal, or by visiting an ATM.

2. What is a FAB Bank prepaid card used for?

It’s mainly used for salary disbursement or controlled spending. The Ratibi card is the most common prepaid card in the UAE.

3. Can I apply for a FAB credit card online?

Yes, you can apply through the FAB website or mobile app. You can also visit a FAB branch for in-person assistance.

4. How do I activate my new FAB Bank card?

Activate it via the FAB Mobile App, customer care helpline, or any FAB ATM.

5. What should I do if my FAB card is lost or stolen?

Immediately block the card via the FAB App or call customer service. You can request a replacement at any FAB branch.

6. Does FAB offer zero balance prepaid cards?

Yes, FAB’s Ratibi card doesn’t require a bank account or balance maintenance.

7. Can I withdraw cash using my FAB credit card?

Yes, but cash advance fees may apply. It’s better to check the card’s terms before withdrawal.

8. Where can I make a FAB Bank card inquiry in UAE?

You can inquire via FAB online banking, the mobile app, or by visiting any FAB branch near you.