FAB Bank Account Types UAE

If you live in the UAE, you’ve probably noticed a major shift in how people choose their bank accounts. Between rising digital adoption, salary transfer perks, and lifestyle-driven financial products, UAE residents today expect more from a bank than just a place to store money. And when it comes to versatile, modern, customer-centric banking, First Abu Dhabi Bank (FAB) continues to lead with a range of account types designed for every kind of resident — from salaried professionals to entrepreneurs, investors, newcomers, and even students.

In fact, as per regional trends, over 70% of new bank customers in the UAE now select accounts based on benefits, not just basic services. FAB has leaned into this shift by offering multiple account categories, each tailored to a specific financial need, spending style, and life stage.

This deep-dive article explores every FAB bank account type in the UAE, explaining features, eligibility, benefits, fees, and who each account is best for — in a conversational, reader-first way optimized for modern AI-powered search.

Whether you’re switching banks, opening a new account, moving to the UAE, or simply exploring your options, consider this your definitive guide to FAB account types.

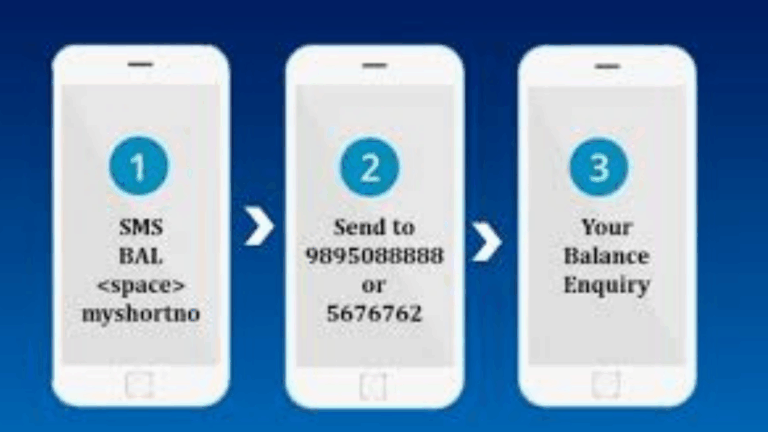

Read More: FAB Balance Check

Understanding FAB Bank Accounts in the UAE

Before we break down each category, it’s worth understanding why FAB stands at the top of the UAE banking ecosystem.

As the UAE’s largest bank and one of the most financially stable institutions in the region, FAB combines:

- Advanced digital banking tools

- Strong global connectivity

- Sharia-compliant solutions

- Specialized wealth management

- Tailored offerings for expats and locals

These elements flow into the different FAB personal account types, business accounts, Islamic accounts, savings categories, and premium banking options.

Now, let’s explore each category in depth.

FAB Personal Account Types

FAB’s personal banking suite is built around usability — simple onboarding, low salary requirements, and lifestyle benefits that match UAE residents’ everyday needs. Below are the core personal account categories.

FAB One Account

The FAB One Account is one of the most popular everyday banking accounts in the UAE, especially for salaried employees.

What makes it stand out?

- No minimum balance (if salary is transferred)

- Free debit card

- Free local transfers

- Discounts across dining, shopping, and entertainment

- 24/7 access through FAB Mobile App

- Salary transfer benefits such as instant overdraft approval and credit card eligibility

Who is it for?

Ideal for UAE residents who want a simple, benefit-packed salary account with no hidden complications.

FAB Current Account

A flexible transactional account offering seamless access to daily banking services.

Key Features

- Available in AED or major foreign currencies

- Chequebook issued

- Online/mobile banking access

- Suitable for individuals and professionals

Who is it best for?

People who need regular cash flow management, especially business owners, freelancers, and frequent global transactors.

FAB Elite Account

A premium account designed for high-income clients seeking exclusive financial privileges.

Highlights

- Dedicated relationship manager

- Exclusive Elite debit and credit cards

- Preferential FX rates

- Invitations to curated events

- High withdrawal limits

Eligibility

Minimum monthly salary or high deposit threshold (varies by segment).

FAB Savings Account Types

Savings accounts at FAB cater to people who want to preserve capital while earning returns. The options cover both conventional and Islamic savings.

FAB iSave Account

A digital-first savings account offering competitive interest rates.

Key Features

- Fast onboarding through FAB Mobile

- Attractive interest rates

- No average balance requirement

- Instant funds transfer to/from accounts

Perfect for users who want:

Safe, quick savings growth without complicated terms.

FAB Smart Savings Account

Designed for customers who want to compartmentalize savings goals.

Highlights

- Categorized savings pockets

- Monthly profit/interest

- Flexible deposits and withdrawals

Best For

Residents who prefer structured saving for travel, emergencies, education, or investments.

FAB Islamic Account Types

FAB is a major provider of Sharia-compliant banking solutions, offering Islamic current and savings accounts under Murabaha and Mudarabah structures.

FAB Islamic Savings Account

Features

- Sharia-compliant profit

- Monthly profit payouts

- Access to Islamic digital banking

- Available in AED and USD

Who needs it?

Individuals who prefer halal banking that follows ethical financial principles.

FAB Islamic Current Account

Benefits

- Free cheque book

- Debit card for ATM and POS

- No interest — only Sharia-approved profit rules

- Transparent, compliance-driven operations

A great fit for those who want Islamic transactional banking without compromise.

FAB Business Account Types

FAB offers a suite of corporate and SME banking accounts supporting the UAE’s vibrant business ecosystem.

FAB Business Advantage Account

This is one of the most widely used SME accounts in the UAE.

Top Features

- Low minimum balance

- Free international business debit card

- Online payroll support (WPS compliant)

- Local/international transfer benefits

Best for

Startups, small enterprises, freelancers, and service providers.

FAB Corporate Current Account

Designed for medium and large enterprises with high transaction volume.

Key Benefits

- Multi-currency support

- Bulk payments

- Trade finance integration

- Tailored treasury solutions

FAB Premium & Wealth Accounts

FAB also offers specialized accounts for affluent individuals, investors, and high-net-worth clients.

FAB Private Banking Account

Exclusive Privileges

- Bespoke wealth advisory

- Global investment products

- Estate planning support

- Priority service channels

Ideal for customers seeking advanced financial management.

FAB Gold & Platinum Accounts

These accounts bridge the gap between standard accounts and high-premium segments.

Features include:

- Higher withdrawal limits

- Attractive credit card bundles

- Lifestyle discounts

- Dedicated support lines

Comparing FAB Account Types — A Snapshot

Below is a simplified comparison for readers assessing the right fit:

| FAB Account Type | Ideal For | Key Benefits |

|---|---|---|

| One Account | Salaried residents | No minimum balance, salary perks |

| Current Account | Daily banking needs | Chequebook, multi-currency |

| Elite Account | High-income clients | Premium services, better FX |

| iSave Account | Digital savers | High interest, easy setup |

| Smart Savings | Goal-based savers | Categorized saving buckets |

| Islamic Accounts | Sharia-compliant users | Halal profit structures |

| Business Advantage | SMEs & freelancers | WPS, low balance, transfers |

| Corporate Account | Large enterprises | Trade finance, bulk payments |

| Private Banking | High-net-worth clients | Personalized wealth solutions |

How to Choose the Right FAB Account in the UAE

Selecting the best account depends on the following factors:

1. Income Level

Higher income unlocks premium categories like Elite, Gold, or Private Banking.

2. Banking Purpose

- Daily transactions → Current Account

- Salary transfer → One Account

- Savings → iSave or Smart Savings

- Business → Business Advantage

3. Sharia Compliance

FAB’s Islamic account suite is ideal for individuals who prefer halal financial instruments.

4. Lifestyle & Spending Habits

Travelers benefit from FX perks, high-spenders from premium cards, and savers from specialized savings accounts.

Digital Banking: FAB Mobile App Advantage

FAB’s mobile app enhances all account types with:

- Instant account opening

- Real-time transfers

- Bill payments

- Savings management

- Card controls

- Salary insights

A major reason why FAB accounts remain popular among UAE residents.

You can link this section to UAEBANKBALANCE.COM’s fintech, apps, or digital-banking category.

Final Thoughts

FAB’s wide range of bank account types reflects the dynamic, multicultural, fast-growing nature of the UAE. Whether you’re a new resident opening your first salary account, a business owner expanding operations, or a saver building long-term financial security, FAB provides a structured, customizable account ecosystem aligned with modern needs.

By understanding the full range of FAB Bank Account Types in the UAE, you can choose an account that fits your financial goals, lifestyle, and future plans — with the reliability of one of the region’s strongest banks.

FAQs on FAB Bank Account Types UAE

1. What is the best FAB account for salary transfer?

The FAB One Account is the most popular choice due to its no-minimum-balance policy and salary-linked benefits.

2. Does FAB offer Sharia-compliant accounts?

Yes, FAB provides Islamic Current Accounts and Islamic Savings Accounts strictly under Sharia principles.

3. What is the minimum salary for FAB One Account?

Usually AED 3,000–5,000 (varies by employer classification).

4. Can I open a FAB iSave account without visiting a branch?

Yes, the FAB Mobile App allows instant digital onboarding.

5. What is the best FAB account for expats?

Expats commonly choose the Current Account, One Account, or iSave Account, depending on their needs.

6. Does FAB have accounts for businesses?

Yes, FAB offers SME-friendly Business Advantage Accounts and Corporate Accounts for larger companies.

7. Which FAB account is best for students?

Students often choose the Savings Account or the basic Current Account due to minimal requirements.

8. Is there a minimum balance requirement?

Some accounts require minimum balances unless salary transfer conditions are met.