FAB Bank Account Opening UAE

Opening a FAB Bank account in the UAE has never been easier. Whether you are a resident, an expatriate, or a business owner, First Abu Dhabi Bank (FAB) offers a wide range of account options, including savings, current, salary, zero balance, and business accounts. These accounts are designed to meet diverse financial needs while offering easy access to digital banking and branch services.

With the UAE rapidly moving toward digital banking, FAB has streamlined its account opening process. Customers can open accounts online, in-branch, or via the mobile app. Additionally, you can easily perform a FAB balance check or a FAB bank balance enquiry to keep track of your funds and manage your finances efficiently.

What is FAB Bank Account Opening?

FAB Bank account opening is the process of registering a new bank account with First Abu Dhabi Bank in the UAE. This process is simple and customer-friendly. It allows individuals and businesses to select from multiple account types, access digital banking, and benefit from a wide range of financial services.

Types of FAB Bank Accounts in UAE

FAB Bank provides several account types to suit different needs. Understanding the features of each account helps you choose the one that fits your financial goals.

FAB Salary Account UAE

The FAB Salary Account is designed for employees in the UAE. It offers convenient salary disbursement and easy access to digital banking services. To open this account, customers typically need to meet a minimum salary requirement starting from AED 5,000, depending on the employer’s partnership with FAB. Salary account holders benefit from direct salary deposits, online banking, mobile app management, and competitive interest on balances.

FAB Savings Account UAE

The FAB Savings Account allows customers to grow their savings while enjoying flexibility. You can choose from accounts that require a minimum deposit or zero balance accounts. Digital banking tools make it easy to check your balance, transfer funds, and pay bills. Interest is compounded daily to ensure your savings grow steadily.

FAB Savings Account Types

- Basic Savings Account: Minimum balance AED 0, Interest rate 2.0%

- Premium Savings Account: Minimum balance AED 1,000, Interest rate 2.5%

FAB Current Account UAE

FAB Current Accounts are ideal for daily financial transactions for individuals and businesses. Features include debit card access, checkbooks, easy transaction tracking, flexible overdraft limits, and online or mobile banking access. This account is designed for users who require frequent transactions and efficient cash flow management.

FAB Zero Balance Account UAE

FAB Zero Balance Accounts promote financial inclusion for students, low-income residents, and young professionals. These accounts do not require a minimum balance and are easy to manage via digital banking. Certain limitations may apply on some transactions, but the account ensures accessible banking for a wide audience.

FAB Bank Business Account UAE

FAB offers a variety of business account solutions to support businesses of all sizes, from small startups to large corporations. Small business accounts provide easy management, online and mobile banking, and optional merchant services. Corporate accounts include treasury management, trade finance, and multi-user access controls. Business accounts can also integrate with loans to provide flexible financing solutions.

Documents Required to Open FAB Account in UAE

To open any FAB Bank account in the UAE, the following documents are typically required:

- Emirates ID (mandatory for residents and UAE citizens)

- Passport copy and UAE visa (for expatriates)

- Proof of address (utility bill, tenancy contract, or employer NOC)

- Proof of income or employment (salary certificate or employment letter)

- Company registration documents (for business accounts)

Step-by-Step: How to Open FAB Bank Account in UAE

Opening a FAB Bank account in the UAE can be done online or physically at a branch, giving customers full flexibility. Both methods are simple, secure, and designed to suit your preferences.

In-Branch Account Opening (Physical Method)

For those who prefer a more personal touch, visiting a FAB branch in the UAE is an excellent option:

- Locate the nearest FAB branch using the FAB website or mobile app. Key branches include Dubai (Al Barsha, Deira, Jumeirah) and Abu Dhabi (Hamdan Street).

- Bring all required documents: Emirates ID, passport, proof of address, proof of employment, and company documents (for business accounts).

- Meet a bank representative who will guide you through the account selection process and answer all your questions.

- Fill out the application forms provided by the branch.

- Submit your documents and application.

- The branch staff will verify your documents on the spot. In many cases, account approval and debit card issuance can be done immediately, depending on the account type.

By offering both online and in-branch account opening, FAB ensures that residents, expatriates, and businesses can select the method that best fits their convenience and comfort level.

Open FAB Bank Account Online in the UAE

Opening a FAB Bank account online is straightforward. Here’s the step-by-step process:

- Visit the official FAB UAE website or download the FAB Mobile App.

- Select the account type: Salary, Savings, Current, Zero Balance, or Business.

- Fill in the online application form with personal and employment details.

- Upload the required documents (Emirates ID, passport, proof of address, etc.).

- Review and submit your application.

- FAB will verify your documents and application, usually within 1–3 business days.

- Once approved, you will receive your account details and digital banking access.

You can also open a FAB Bank account in-branch for personal assistance and faster document verification.

FAB Bank Balance Check & Enquiry Options

After opening your account, you can check your account balance or perform a FAB bank balance Inquiry through multiple convenient options:

- FAB Mobile App: Get instant balance updates and transaction history.

- Online Banking: Access your account via desktop or laptop for balance checks and fund transfers.

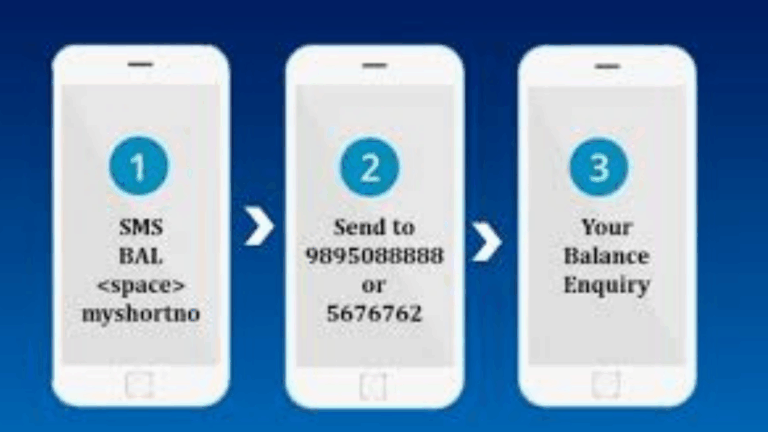

- SMS Banking: Receive your account balance via SMS from FAB’s official number.

- ATMs: Use FAB ATMs across the UAE for quick balance checks or mini statements.

- In-Branch: Visit any FAB branch for personalized assistance.

FAB Mobile Banking & App Features UAE

The FAB Mobile App provides an excellent platform to manage your account on the go. Features include:

- Instant balance updates and transaction alerts

- Local and international fund transfers

- Bill payments and mobile top-ups

- Debit and credit card management

- Loan and credit card applications

FAB Branch Network in UAE

FAB has a wide branch network across the UAE, including Dubai, Abu Dhabi, Sharjah, and Ajman. Some key branches include:

- FAB Al Barsha Branch: Near Mall of the Emirates, Dubai – Personal, Business, Salary Accounts, Loans, Cards

- FAB Jumeirah Branch: Jumeirah Beach Road, Dubai – Personal, Premium, Islamic Banking, Cards

- FAB Deira Branch: Al Ghurair Centre, Dubai – Personal, Business, Salary Accounts, Digital Banking

- FAB Abu Dhabi Main Branch: Hamdan Street, Abu Dhabi – Corporate Accounts, Business Solutions, Loans

- FAB Ajman Branch: Ajman Corniche – Personal, Salary Accounts, Cards

Why Choose FAB Bank UAE

FAB Bank provides a seamless account opening experience and a wide variety of accounts to suit all financial needs. Key advantages include:

- Online and in-branch account opening options

- A broad selection of accounts: Savings, Current, Salary, Zero Balance, Business

- Digital banking with mobile and online access

- Competitive interest rates and flexible account features

- Strong customer support in the UAE

Benefits of Opening a FAB Bank Account

- Easy online and in-branch account opening

- Access to a range of account types for individuals, students, employees, and businesses

- Flexible digital banking services for seamless financial management

- Zero balance accounts for financial inclusion

- Business solutions for SMEs and corporate clients

- Quick and efficient customer support

Tips for Smooth FAB Account Opening in UAE

- Ensure all documents are valid and complete before applying.

- For salary accounts, confirm your employer’s partnership with FAB for smoother processing.

- Use the FAB Mobile App to track application status and perform balance checks.

- For business accounts, prepare company registration and trade documents in advance.

Conclusion

Opening a FAB Bank account in the UAE is a simple and efficient way to manage your finances. Whether you are looking for a savings account, salary account, current account, zero balance account, or business account, FAB offers options to meet your needs. With online and in-branch account opening, digital banking tools, and UAE-specific services, FAB ensures a convenient and rewarding banking experience.

By choosing FAB Bank, customers can enjoy competitive interest rates, robust digital banking features, and dedicated customer support. Make the most of your FAB Bank account by exploring its services, including online banking, mobile banking, and business solutions.

FAQ

Q1: What are the requirements for opening a FAB Bank salary account?

A: You need to meet the minimum salary criteria and provide identification, proof of employment, and proof of address.

Q2: Can I open a FAB Bank account online in UAE?

A: Yes, FAB offers online account opening options for convenience.

Q3: What is the minimum balance requirement for a FAB Bank savings account?

A: It depends on the account type. Basic Savings Accounts require AED 0, while Premium Savings Accounts may require AED 1,000.

Q4: Does FAB Bank offer zero balance accounts?

A: Yes, these accounts are ideal for students and low-income residents.

Q5: What are the benefits of opening a FAB Bank current account?

A: Features include debit card access, checkbook facilities, online and mobile banking, and overdraft facilities.

Q6: Can I convert my standard FAB Bank account to a zero balance account?

A: Yes, eligible customers can convert their account after meeting FAB’s requirements.

Q7: What documentation is required for opening a FAB Bank company account?

A: Company registration documents, authorized signatories’ ID, and proof of address are required.

Q8: How do I manage my FAB Bank business account?

A: FAB provides digital tools, multi-user access, and controls for efficient account management.

Q9: What kind of customer support is available for new account opening?

A: FAB offers in-branch assistance, phone support, and online help to guide new customers.

Q10: Can I upgrade or downgrade my FAB Bank account?

A: Yes, customers can upgrade or downgrade accounts depending on their financial needs