Emirates NBD SWIFT Code UAE

Overview

Millions of UAE residents and businesses are involved in international money transfer in the modern global economy. Whether you’re sending funds to family abroad, paying overseas suppliers, or receiving payments from global clients, one crucial element connects every transaction: the Emirates NBD SWIFT Code. It is crucial that customers are aware of the correct SWIFT code to use for smooth, secure, and prompt intercountry transfers with the bank.

Read More: Explore other UAE banking insights — including FAB SWIFT Codes, ADCB swift code Guide, and Mashreq bank Swift code — only on Uaebankbalance.com, your trusted destination for UAE finance, business, and lifestyle updates.

Understanding SWIFT Codes: The Passport of International Banking

A SWIFT code, sometimes referred to as a Bank Identifier Code (BIC), acts like a digital passport for banks in global transactions. It ensures that money sent from one financial institution reaches the correct destination safely and efficiently.

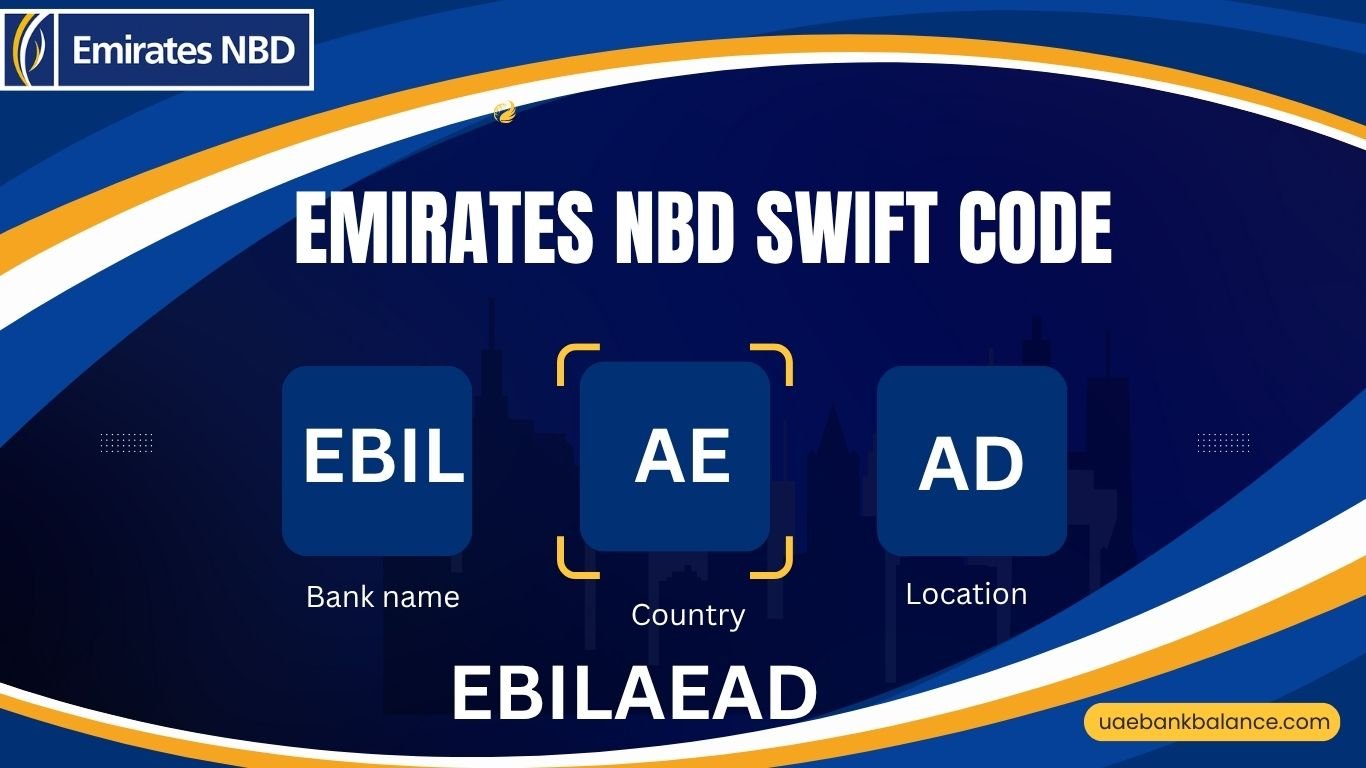

Each SWIFT code uniquely identifies a bank, and sometimes a specific branch, during wire transfers between countries. The code typically consists of 8 or 11 alphanumeric characters, structured as follows:

- First 4 letters: Bank code (identifies the bank)

- Next 2 letters: Country code

- Next 2 letters: Location code

- Last 3 letters (optional): Branch code

For Emirates NBD, the standard SWIFT code for most international transfers is:

EBILAEAD

Let’s break it down:

- EBIL = Emirates Bank International Limited (Emirates NBD’s former name)

- AE = United Arab Emirates

- AD = Dubai (head office location)

This universal code is recognized by banks worldwide for processing international transfers to Emirates NBD accounts within the UAE.

Why the Emirates NBD SWIFT Code Matters

In a financial ecosystem as globally connected as the UAE, SWIFT codes are not just technical details — they’re vital to ensuring funds arrive safely and without delay. Here’s why knowing your Emirates NBD SWIFT code is so important:

- Accuracy: A wrong SWIFT code can delay transactions or even result in funds being returned.

- Speed: The correct code enables faster routing through the SWIFT network, reducing international transfer times.

- Transparency: It guarantees your transfer is traceable from sender to receiver.

- Compliance: Emirates NBD complies with international banking standards through the SWIFT system, ensuring all transactions meet global security norms.

Whether you’re transferring AED, USD, GBP, or EUR, including the correct SWIFT code ensures your money reaches the right Emirates NBD account swiftly and securely.

Emirates NBD: A Pillar of UAE Banking

Before diving into specific SWIFT codes by branch, it’s worth understanding why Emirates NBD plays such a central role in international finance.

Formed in 2007 after the merger of Emirates Bank International (EBI) and National Bank of Dubai (NBD), the institution has grown into one of the largest banking groups in the Middle East, serving millions of retail and corporate customers.

Headquartered in Dubai, Emirates NBD operates over 900 ATMs, 150+ branches, and digital channels that span more than 20 countries, including major financial hubs in Egypt, India, the UK, and Saudi Arabia.

Its integration with the SWIFT global payment network has positioned it as a trusted gateway for cross-border payments, remittances, and trade finance — making it a cornerstone of the UAE’s modern economy.

Emirates NBD SWIFT Code (Head Office – Dubai)

If you are sending or receiving funds to an Emirates NBD account in the UAE and are unsure of the specific branch code, always use the main head office SWIFT code:

EBILAEAD

This code covers most personal and corporate accounts across Dubai and the UAE. However, for business or corporate transactions, using a branch-specific SWIFT code can sometimes ensure faster crediting and reduced processing delays.

Branch-Wise Emirates NBD SWIFT Codes in the UAE

Below are some of the key Emirates NBD branch SWIFT codes to help you process international transfers accurately:

| Branch Location | SWIFT Code | City / Emirate |

|---|---|---|

| Head Office | EBILAEAD | Dubai |

| Abu Dhabi Main Branch | EBILAEADABD | Abu Dhabi |

| Sharjah Branch | EBILAEADSHJ | Sharjah |

| Deira Branch | EBILAEADDER | Dubai (Deira) |

| Jebel Ali Branch | EBILAEADJAL | Dubai (Jebel Ali) |

| Al Ain Branch | EBILAEADAIN | Al Ain |

| Ras Al Khaimah Branch | EBILAEADRAK | Ras Al Khaimah |

| Fujairah Branch | EBILAEADFUJ | Fujairah |

| Ajman Branch | EBILAEADAJM | Ajman |

⚠️ Note: When in doubt, always confirm the branch SWIFT code with Emirates NBD customer support or your bank relationship manager before initiating a large transfer.

How to Use the Emirates NBD SWIFT Code for Transfers

Using a SWIFT code is simple but essential for any international transaction. Here’s what you’ll need to complete an incoming or outgoing transfer involving Emirates NBD:

For Incoming Transfers (Receiving Money)

Provide the sender with:

- Your full name as per account

- Emirates NBD account number / IBAN

- SWIFT Code: EBILAEAD (or branch-specific)

- Bank name: Emirates NBD Bank PJSC

- Branch name: As applicable

- Bank address: Emirates NBD, Baniyas Road, Deira, Dubai, UAE

For Outgoing Transfers (Sending Money)

When sending money abroad from your Emirates NBD account:

- Log into your online banking or mobile app

- Choose “International Transfer”

- Enter the recipient’s SWIFT/BIC code

- Confirm beneficiary’s name and IBAN

- Verify fees and exchange rates

- Approve the transfer

Emirates NBD provides real-time currency conversion, transparent transfer fees, and SWIFT tracking for every transaction.

Emirates NBD SWIFT Code for Business & Corporate Banking

For corporate clients, SWIFT transfers are integral to daily operations — from supplier payments to trade finance. Emirates NBD offers:

- SWIFT GPI-enabled transfers for real-time tracking

- Multi-currency account support (AED, USD, EUR, GBP, INR)

- Dedicated relationship management for business clients

- Integrated ERP compatibility through its corporate banking platform

The same main SWIFT code — EBILAEAD — is used for most corporate transfers, unless your company operates under a specialized account or division with a separate code.

Transfer Fees and Processing Time

Emirates NBD’s international transfer fees vary depending on currency, destination, and channel (branch, online, or mobile). On average:

- Online banking transfers: AED 40–60

- Branch transfers: AED 75–100

- Processing time: 1–3 business days

SWIFT GPI-enabled payments can often be tracked in real time, allowing you to monitor your transfer status directly through Emirates NBD’s online platform.

Safety, Compliance, and Transparency

Emirates NBD operates under the Central Bank of the UAE’s regulations and complies with international financial security standards, including SWIFT’s Customer Security Programme (CSP).

Every transaction is encrypted, monitored, and verified through secure global channels — ensuring both sender and receiver are protected from fraud and unauthorized access.

Digital Banking & SWIFT Integration

Emirates NBD’s robust digital infrastructure connects its mobile app and online platform directly to the SWIFT network. This means customers can initiate, track, and confirm international transfers without visiting a branch.

Key digital features include:

- SWIFT GPI tracking via mobile app

- Instant status updates on international transfers

- Currency rate lock during transfer

- Beneficiary management for frequent recipients

How to Find Your Emirates NBD Branch SWIFT Code

You can find your branch’s SWIFT code through:

- The bottom of your bank statement

- The Emirates NBD mobile app (Transfer details section)

- The official Emirates NBD website (branch locator)

- By calling +971 600 540000 (Emirates NBD customer service)

Always verify before transferring large sums internationally to avoid routing errors.

Frequently Asked Questions (FAQ)

1. What is the SWIFT code for Emirates NBD UAE?

The general SWIFT code for Emirates NBD UAE is EBILAEAD.

2. Do Emirates NBD branches have different SWIFT codes?

Yes, major branches such as Abu Dhabi, Sharjah, and Deira have unique extensions for faster routing.

3. Can I use the main SWIFT code for all transfers?

Yes, for most individual and business transactions, the main SWIFT code (EBILAEAD) works for all Emirates NBD accounts.

4. How long do international transfers take?

Typically, 1–3 business days, depending on the destination country and intermediary banks.

5. Are there extra charges for SWIFT transfers?

Emirates NBD may charge between AED 40–100, depending on transfer mode and currency.

6. Can I track my transfer?

Yes, Emirates NBD’s SWIFT GPI feature lets you track your transfer in real time.

7. Are SWIFT transfers secure?

Absolutely. SWIFT transactions are encrypted, monitored, and compliant with global banking standards.

8. What if I use the wrong SWIFT code?

Funds may be delayed or returned. Always confirm with your branch before initiating a transfer.