In a global financial hub like the UAE, sending and receiving money across borders is part of everyday life. From expatriates supporting families overseas to businesses settling international invoices, cross-border transfers are routine. This is why searches for emirates islamic bank swift code are common and highly intentional. People are not just looking for a code. They want accuracy, clarity, and confidence that their international transfer will reach the right destination without delays.

For customers of Emirates Islamic Bank, understanding the SWIFT code is especially important because it connects Sharia-compliant banking in the UAE with the global financial system. This guide explains what the Emirates Islamic Bank SWIFT code is, why it matters, how to use it correctly, and what to watch out for when making international transfers.

What Is a SWIFT Code and Why It Matters

A SWIFT code, also known as a Bank Identifier Code, is a unique international code used to identify banks during cross-border transactions. It ensures that money sent from one country reaches the correct bank and branch in another country.

In simple terms, a SWIFT code acts like a global address for banks.

Without the correct SWIFT code:

- International transfers can be delayed

- Funds may be returned

- Additional fees may apply

- Payments may reach the wrong institution

For Emirates Islamic Bank customers, using the correct SWIFT code is essential for smooth international banking.

Emirates Islamic Bank SWIFT Code Explained

The primary Emirates Islamic Bank SWIFT code is used for most international transfers sent to the bank’s main operations in the UAE.

Emirates Islamic Bank SWIFT Code Details

| Detail | Information |

|---|---|

| Bank Name | Emirates Islamic Bank |

| SWIFT Code | MEBLAEAD |

| Country | United Arab Emirates |

| City | Dubai |

| Usage | International transfers |

This SWIFT code is widely accepted for receiving international remittances into Emirates Islamic accounts.

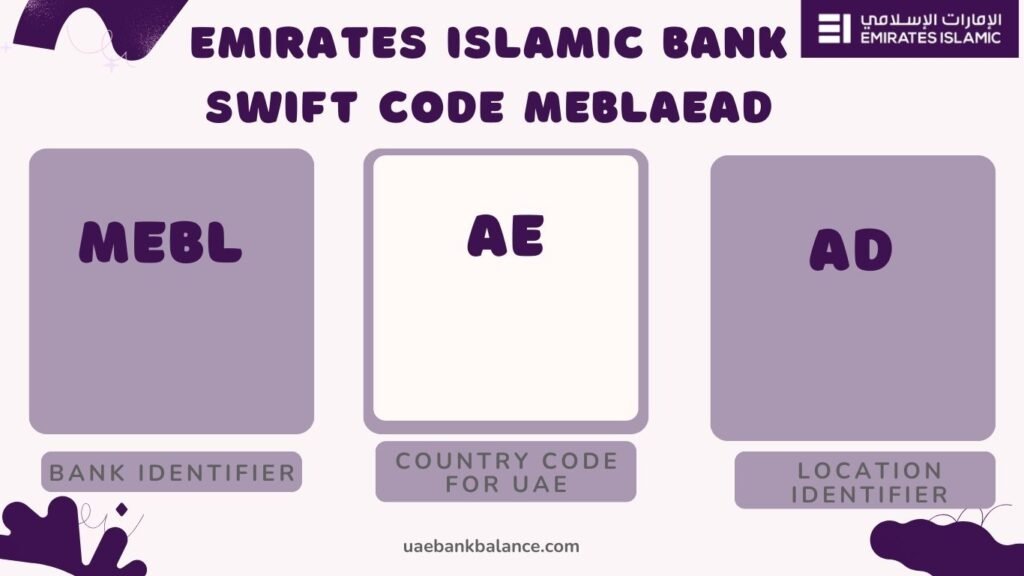

Breaking Down the Emirates Islamic Bank SWIFT Code

Understanding the structure of the SWIFT code helps avoid confusion.

| Code Segment | Meaning |

|---|---|

| MEBL | Bank identifier |

| AE | Country code for UAE |

| AD | Location identifier |

Each part plays a role in routing funds correctly through international banking networks.

When You Need the Emirates Islamic Bank SWIFT Code

You will typically need the Emirates Islamic Bank SWIFT code in the following situations:

- Receiving salary from abroad

- International wire transfers

- Overseas business payments

- Educational fee payments

- Property related transfers

- Investment inflows

Any time money crosses borders into your Emirates Islamic account, the SWIFT code becomes essential.

Using Emirates Islamic Bank SWIFT Code for Incoming Transfers

When someone sends money to your Emirates Islamic account from outside the UAE, they must provide accurate banking details.

Details Required for Incoming Transfers

| Required Information | Why It Is Needed |

|---|---|

| Account holder name | Identity verification |

| Account number or IBAN | Correct crediting |

| Bank name | Routing clarity |

| Emirates Islamic Bank SWIFT code | International identification |

| Branch details | Additional accuracy |

Providing complete and accurate information reduces processing time.

SWIFT Code vs IBAN for Emirates Islamic Bank

Many customers confuse SWIFT codes with IBANs. While both are important, they serve different purposes.

| Feature | SWIFT Code | IBAN |

|---|---|---|

| Purpose | Identify bank | Identify account |

| Used for | International routing | Account credit |

| Length | 8 or 11 characters | Longer numeric format |

| Required | Yes for international transfers | Yes for account accuracy |

For successful transfers, both are usually required.

Emirates Islamic Bank SWIFT Code for Outgoing Transfers

When sending money abroad from an Emirates Islamic account, the bank uses SWIFT messaging to communicate with international banks.

Outgoing transfers typically involve:

- SWIFT messaging network

- Correspondent banks

- Currency conversion

- Compliance checks

The accuracy of recipient bank SWIFT details is just as important as providing your own.

Processing Time for SWIFT Transfers at Emirates Islamic Bank

International transfers are not instant, but Emirates Islamic aims to process them efficiently.

Typical Transfer Timeline

| Transfer Type | Estimated Time |

|---|---|

| Standard international transfer | 2 to 5 working days |

| High-value transfers | Subject to checks |

| Weekend submissions | Processed next working day |

Delays can occur due to intermediary banks or incorrect details.

Fees Associated with SWIFT Transfers

While Emirates Islamic operates under Sharia principles, service-related fees still apply.

Common Fee Types

| Fee Type | Description |

|---|---|

| Transfer fee | Bank processing |

| Correspondent bank fee | Third-party banks |

| Currency conversion | Exchange margin |

Understanding fees in advance helps manage expectations.

SWIFT Transfers and Sharia Compliance

One common question among Islamic banking customers is whether SWIFT transfers align with Sharia principles.

SWIFT is simply a communication system, not a financial product. Emirates Islamic ensures that:

- Transfer structures remain compliant

- No interest-based elements are applied

- Fees are transparent and disclosed

This makes SWIFT transfers suitable for Islamic banking customers.

Common Mistakes to Avoid When Using SWIFT Code

Even a small error can delay or cancel a transfer.

Mistakes to Watch For

| Mistake | Impact |

|---|---|

| Incorrect SWIFT code | Transfer rejection |

| Wrong IBAN | Funds misrouting |

| Missing beneficiary details | Processing delays |

| Using outdated information | Return of funds |

Always double-check details before confirming a transfer.

How to Verify Emirates Islamic Bank SWIFT Code

To ensure accuracy, customers should rely on official sources.

Reliable verification methods include:

- Emirates Islamic official website

- Mobile banking app

- Customer care confirmation

- Official bank documents

Avoid relying on unverified third-party sources.

Role of UAEBANKBALANCE.COM in Banking Clarity

UAEBANKBALANCE.COM helps users by:

- Explaining banking terms clearly

- Providing UAE-focused financial guides

- Supporting informed decision-making

- Covering Islamic and conventional banking topics

Articles like Emirates Islamic Bank’s SWIFT code help bridge knowledge gaps for everyday users.

Final Thoughts

The emirates islamic bank swift code is a small detail with a big impact. In a country deeply connected to global finance, understanding how international transfers work is essential. Whether you are receiving money from overseas, managing business payments, or supporting family abroad, using the correct SWIFT code ensures your funds move smoothly and securely. Emirates Islamic Bank combines global banking connectivity with Islamic finance values, giving customers confidence at every step.

Frequently Asked Questions

What is the Emirates Islamic Bank SWIFT code?

The commonly used SWIFT code is MEBLAEAD.

Do all Emirates Islamic branches use the same SWIFT code?

Yes, the primary SWIFT code is generally used for all branches.

Is SWIFT code required for receiving money from abroad?

Yes, it is essential for international transfers.

Can I find my SWIFT code on bank statements?

It may appear on official bank documents or online banking.

Does Emirates Islamic charge fees for SWIFT transfers?

Yes, service and correspondent fees may apply.