The Unseen Passport to your Money: How to transfer money across the world with your Dubai Islamic Bank Swift Code.

In a country that is based on international interconnection, where remittance is as normal a flow as the one that goes through the Sheikh Zayed Road, your money needs a convenient safe route to its foreign destination. You are sending money back home, you are financing an education in a foreign country, you are sealing a business deal in a foreign country: a single set of characters serves as the passport of your money: the SWIFT code. To millions of people who entrust their money to the hands of the Dubai Islamic Bank, it is important to note that the first important step in a successful cross-border trip is to get the right SWIFT/BIC.

But what is wrong with this code? It is not just a mere delay. It may translate to your Dirhams that you worked so hard being trapped in a red tape, expensive recovery charges and a lot of frustration. It is not just a list of the code presented in this guide by UAEBANKBALANCE.COM. We will make the whole system demystical and your subsequent international transfer of your Dubai Islamic Bank account is not just going to be successful but also effective, cost-effective and entirely compliant to the ideals of safe and transparent banking.

READ MORE: MASTER YOUR UAE BANKING

At UAEBANKBALANCE.COM, we are your trusted partner for navigating the financial landscape of the Emirates. Deepen your knowledge with our other comprehensive guides:

- Managing Your Accounts: Learn the easiest ways to check your balances.

- Exploring Other Banks: Compare your options with our detailed reviews.

More Than an Acronym: What a SWIFT Code Really Is

Let’s move past the technical jargon. The SWIFT code (which stands for Society for Worldwide Interbank Financial Telecommunication) and its sibling, the BIC (Bank Identifier Code), are essentially the global financial system’s postal service and ID card combined. Think of it this way: to send a physical package from Dubai to Manila, you need a specific house address, a postal code, and the country name. The SWIFT code provides this same precise “address” for money.

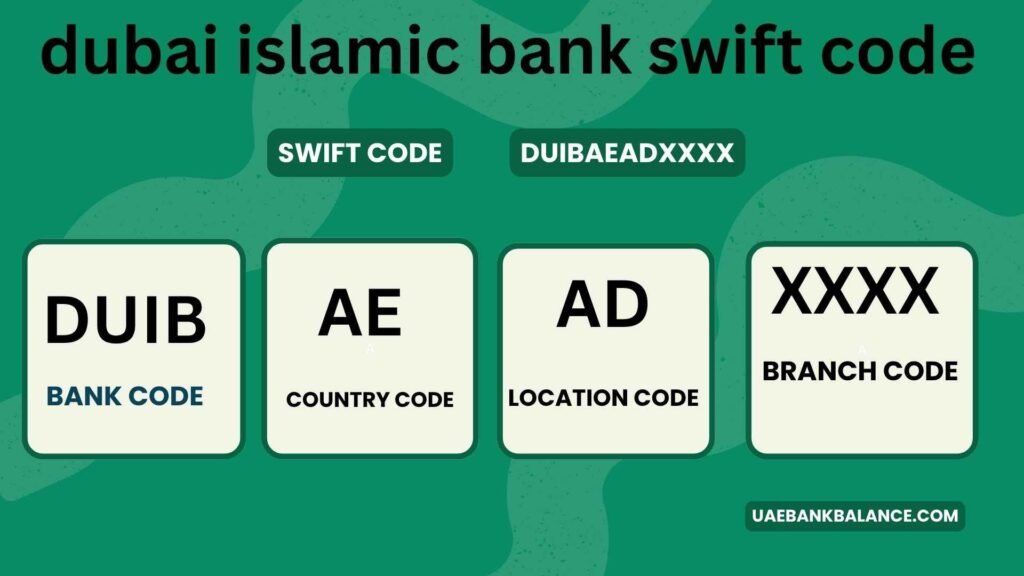

It’s an 8 or 11-character unique identifier that tells the global banking network three key things:

- Who the bank is: The first four characters represent the bank’s code (e.g.,

DUIBfor Dubai Islamic Bank). - Where it is: The next two characters are the country code (

AEfor UAE), and the following two pinpoint the location or head office. - Which specific branch: The final three characters (which are optional) identify a particular branch.

For Dubai Islamic Bank, the primary and most widely used code is DUIBAEAD. This code is your master key for directing funds to the bank’s central hub in the UAE.

The Correct Dubai Islamic Bank Swift Code: Your Key to Global Transactions

After verifying with the bank’s official resources and the international SWIFT registry, the definitive SWIFT/BIC for Dubai Islamic Bank for most international wire transfers is:

DUIBAEAD

DUIB: The unique code for Dubai Islamic Bank.AE: The ISO country code for the United Arab Emirates.AD: The location code for Dubai, specifically referring to the head office.

This code is used when you are sending money to a Dubai Islamic Bank account from anywhere in the world. It ensures the funds are routed to the DIB network in the UAE. From there, the bank uses the recipient’s individual account number (IBAN) to deposit the money into the correct account.

When Do You Need an 11-Character Code?

You will typically use the 8-character code DUIBAEAD. However, some overseas banks, particularly those with older systems, might request an 11-character code. In this case, you can use the head office identifier:

DUIBAEADXXX

The XXX signifies the head office. For 99% of transactions, providing either DUIBAEAD or DUIBAEADXXX will successfully route your transfer to the Dubai Islamic Bank system in the UAE.

A Step-by-Step Guide to Initiating a Wire Transfer from Your DIB Account

Knowing the code is one thing; using it correctly is another. Here is a practical, step-by-step guide to sending money abroad through Dubai Islamic Bank‘s digital or branch channels.

- Gather All Recipient Details: This is the most critical phase. You will need:

- Recipient’s Full Name: As it appears on their bank account.

- Recipient’s Full Address: Including country.

- Recipient’s Bank Name: The name of their financial institution.

- Recipient’s Bank SWIFT/BIC: The code for their bank in their country.

- Recipient’s IBAN (International Bank Account Number) or Account Number: The IBAN is the preferred and most reliable identifier globally.

- Log In to Your Chosen Channel: Access your DIB Online Banking portal or the DIB Mobile App. Alternatively, visit a branch for assisted service.

- Navigate to “Wire Transfer” or “International Transfer”: Within the platform, locate the section for sending money abroad.

- Input the Recipient’s Bank Information: This is where you use the recipient’s SWIFT code, not DIB’s. You will enter the bank name, SWIFT/BIC, and the recipient’s IBAN.

- Input the Transfer Details: Specify the amount and the currency (e.g., USD, EUR, INR, PKR). Be aware of exchange rates and transfer fees at this stage.

- Review and Confirm: Double-check every single character, especially the SWIFT codes and IBAN. A single typo can send your money to the wrong bank or cause significant delays. Once confirmed, authorize the transaction.

For a deeper understanding of managing your finances digitally, explore our guide to the best digital banking apps in the UAE, which includes a look at DIB’s feature-rich platform.

Crucial Considerations for a Smooth International Transfer

To ensure your experience is hassle-free, keep these expert tips in mind:

- Fees are a Two-Way Street: Be aware that Dubai Islamic Bank will charge an outgoing wire transfer fee. Additionally, intermediary banks (correspondent banks that handle the transfer between countries) may deduct their own fees. The recipient’s bank might also charge an incoming wire fee. This can sometimes reduce the final amount received.

- The Purpose of Payment: Most banks, including DIB, require you to state the purpose of the transfer (e.g., “Family Maintenance,” “Education Fees,” “Invoice Payment”). Be accurate, as this is part of international regulatory compliance.

- Transaction Limits: Your account may have daily or transactional limits for international wires. Ensure your transfer amount is within these limits, which you can usually check via the DIB Mobile App or by calling customer service.

- Timing is Everything: While SWIFT transfers are relatively fast, they are not instant. They can take between 1 to 5 business days depending on the destination country, currencies involved, and the efficiency of the intermediary banks. Avoid initiating transfers on weekends or UAE public holidays, as this will add to the processing time.

Frequently Asked Questions (FAQ)

Q1: Is there a different Dubai Islamic Bank SWIFT code for different branches?

For international incoming transfers, no. The central code DUIBAEAD is used for all branches. The bank’s internal system uses the recipient’s IBAN, which contains branch information, to direct the funds to the specific account. However, if you are sending money from a specific DIB branch abroad, that branch might have its own 11-digit code. Always confirm with the sending branch in that case.

Q2: What is the difference between a SWIFT code and an IBAN?

They work together but serve different purposes. The SWIFT code identifies the specific bank and its country in the global network. The IBAN identifies the individual customer’s account within that bank. You need both to ensure the money reaches the right person at the right bank.

Q3: I’m sending money to my own DIB account from overseas. What details do I give?

You will need to provide your overseas bank with:

- Beneficiary Name: Your name as on your DIB account.

- Beneficiary Bank: Dubai Islamic Bank.

- SWIFT Code:

DUIBAEAD - IBAN: Your personal Dubai Islamic Bank account’s IBAN.

Q4: What happens if I use the wrong SWIFT code?

If the wrong code points to a non-existent bank, the transfer will likely be rejected and returned to you, minus any processing fees. If, by rare chance, the wrong code corresponds to a different existing bank, your funds could be sent to the wrong institution, leading to a complex and lengthy recovery process. Always triple-check the code.

Q5: Is the SWIFT code the same for UAE Dirham (AED) and US Dollar (USD) transfers?

Yes, the SWIFT code DUIBAEAD identifies the bank itself, regardless of the currency being transferred. The currency is a separate field in the wire transfer instruction.

Q6: Where can I find my recipient’s SWIFT code?

The most reliable source is always the recipient themselves. They should obtain it directly from their bank statement, their online banking portal, or by contacting their bank’s customer service. Never rely on unverified online sources for another bank’s SWIFT code.

Final Thoughts: Your Confidence for Cross-Border Finance

Mastering the use of the Dubai Islamic Bank SWIFT code DUIBAEAD is more than a technicality—it’s an essential skill for anyone managing finances in the globally-connected UAE. It empowers you to send and receive funds with confidence, ensuring your financial support, business payments, and personal investments reach their intended destination securely and efficiently. By understanding the process, from gathering the correct details to navigating potential fees, you transform a complex international procedure into a simple, routine transaction.

For all your financial inquiries and to stay updated on the latest banking news and trends in the Emirates, keep UAEBANKBALANCE.COM bookmarked as your trusted local resource. We’re here to ensure you navigate the UAE’s dynamic financial landscape with ease and authority.