ADCB Swift Code UAE: Everything You Need to Know for Global Transfers

In today’s global world, moving money across borders has become a normal part of life. Whether you’re a business owner in Dubai paying suppliers overseas, a student in Abu Dhabi receiving funds from your family, or an expat sending money home — international transfers are now part of everyday banking. And at the center of all this is one crucial detail: the SWIFT code.

If you’ve ever tried to send or receive money from abroad, you’ve likely come across this term. For customers of Abu Dhabi Commercial Bank (ADCB), understanding the ADCB SWIFT code is essential. It’s not just a banking formality — it’s the key that connects your account in the UAE to financial institutions around the world.

In this guide, we’ll explore what the ADCB SWIFT code is, how it works, why you need it, and how to use it for seamless international transfers.

What Is a SWIFT Code and Why Does It Matter?

Before diving into ADCB’s specific code, let’s understand the basics. A SWIFT code — also known as a Bank Identifier Code (BIC) — is an international standard for identifying banks and financial institutions. Think of it like an international passport for your bank.

Just as your passport identifies you at airports, a SWIFT code identifies your bank during a cross-border transaction. It ensures that the money you send from one country reaches the correct financial institution and the right account.

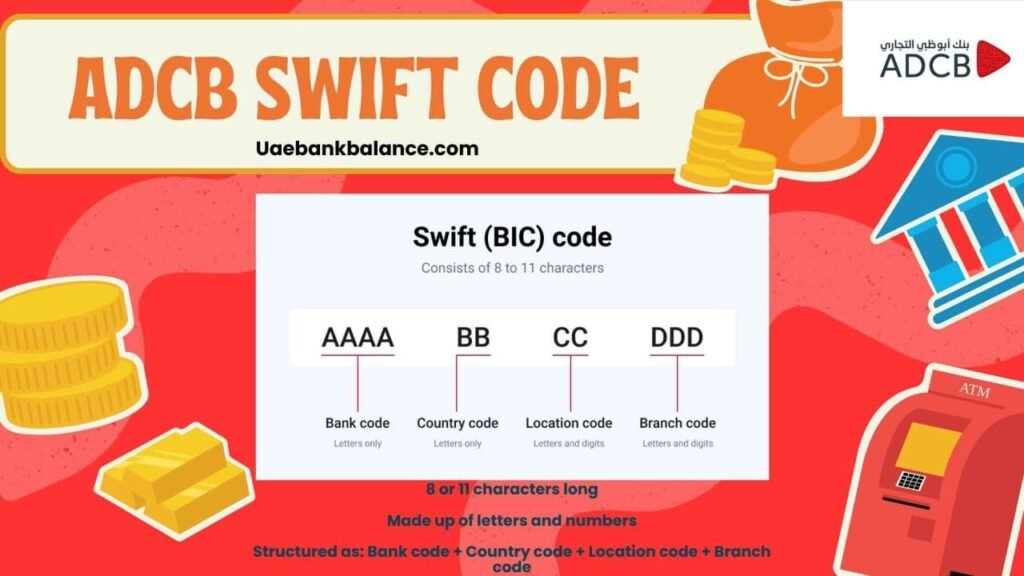

Here’s how a SWIFT code typically looks:

- 8 or 11 characters long

- Made up of letters and numbers

- Structured as: Bank code + Country code + Location code + Branch code

For example, the main SWIFT code of ADCB UAE is:

ADCBUAEA

Here’s how it breaks down:

- ADCB – Abu Dhabi Commercial Bank

- AE – United Arab Emirates (country code)

- A – Bank location (Abu Dhabi)

ADCB Swift Code: Main Branch and Global Use

The official SWIFT code for ADCB UAE main branch is:

ADCBUAEA

This code is used for most international transactions. Whether you are receiving funds from the UK, transferring money to India, or paying a supplier in Europe — this is the code you’ll need to share.

However, ADCB also operates through multiple branches and specialized departments. In most cases, using the main branch SWIFT code is sufficient, even if your account is in a different branch. Banks use this code to route your transaction internally to the correct account.

When to Use ADCB SWIFT Code

- Receiving an international wire transfer from abroad

- Sending money overseas from your ADCB account

- Making global business payments or settling invoices

- Receiving tuition payments from another country

- Paying for international investments or property purchases

How SWIFT Codes Work in an International Transfer

To understand why the ADCB swift code main branch is so important, it helps to know how global money transfers actually happen.

When you initiate a transfer from one country to another, several banks may be involved. The SWIFT code ensures each bank in the chain knows exactly where the money should go. Here’s a simplified version of the process:

- You request a transfer from your ADCB account to a foreign bank.

- ADCB uses the recipient’s SWIFT code to identify the destination bank.

- The transaction is processed through the secure SWIFT network.

- Correspondent banks (intermediate banks) may assist in routing the funds.

- The recipient’s bank receives the money and credits it to the correct account.

Without the correct SWIFT code, the transaction could be delayed, rejected, or sent to the wrong bank.

How to Find Your ADCB SWIFT Code

If you’re unsure where to find the ADCB SWIFT code, here are the most reliable ways:

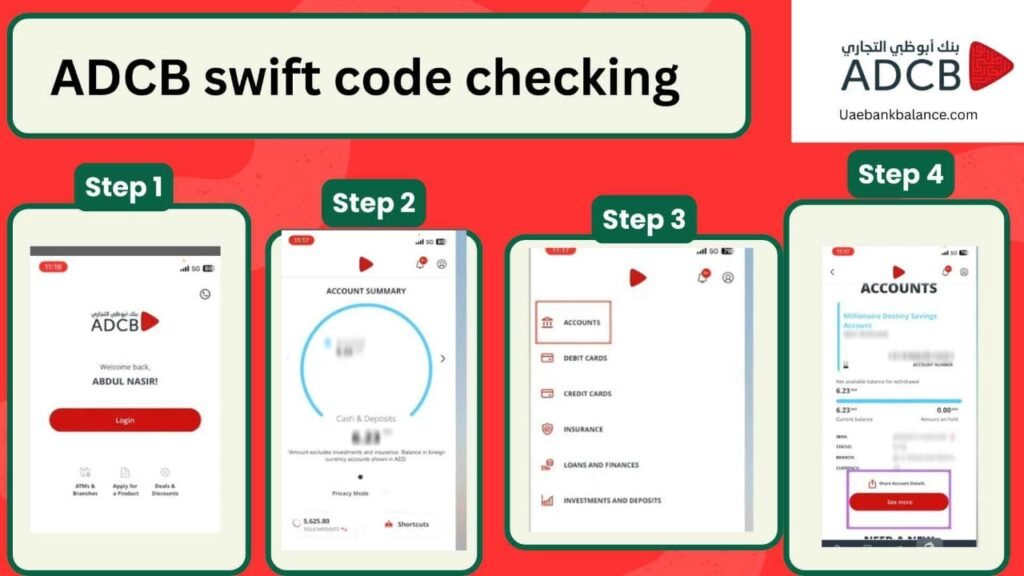

1. ADCB Online Banking or Mobile App

Log in to your ADCB online banking account or mobile app. The SWIFT/BIC code is often listed under account details or international transfer information.

2. Bank Statement

Most bank statements include your SWIFT code near your IBAN and account number.

3. Visit a Branch or Contact Customer Support

You can also call ADCB’s customer care or visit a branch in person to confirm the correct SWIFT code for your account type.

4. Official ADCB Website

The official site of Abu Dhabi Commercial Bank often lists SWIFT codes for various services and branches.

ADCB Swift Code vs. IBAN: What’s the Difference?

A common confusion among customers is the difference between a SWIFT code and an IBAN (International Bank Account Number). While both are used in international transfers, they serve different roles:

- SWIFT Code: Identifies the bank

- IBAN: Identifies the specific account within the bank

In other words, think of the SWIFT code as the address of the building, and the IBAN as the apartment number. You’ll usually need to provide both when receiving international funds.

Tips for Sending and Receiving International Transfers with ADCB

International banking can feel complex, but with the right information, it becomes simple. Here are a few tips to ensure your transfers go smoothly:

Double-Check All Details

Always verify the recipient’s name, IBAN, and SWIFT code before sending. Even a small mistake can delay the transfer.

Be Aware of Fees

ADCB charges certain fees for sending or receiving money internationally. It’s a good idea to check the latest fee schedule before making a transfer.

Timing Matters

Most SWIFT transfers take 1–3 working days. Plan ahead, especially for urgent payments like tuition fees or property transactions.

Use Online Banking for Convenience

The ADCB mobile app and online platform make it easy to initiate international transfers from anywhere in the UAE.

ADCB and the UAE’s Role in Global Finance

Abu Dhabi Commercial Bank is one of the UAE’s most influential banks, playing a vital role in connecting the country to the global financial system. As the UAE continues to grow as a hub for trade, investment, and innovation, banks like ADCB make cross-border transactions simple, safe, and fast.

The ADCB swift code is a small but crucial part of that system. It represents the UAE’s strong ties to international markets and its commitment to being a leader in global finance.

Also Read on UAE Bank Balance

FAQ: ADCB SWIFT Code UAE

Q1: What is the SWIFT code for ADCB UAE main branch?

The official SWIFT code for ADCB main branch is ADCBUAEA. This code is used for most international money transfers.

Q2: Do I need a different SWIFT code for different branches?

No. In most cases, the main branch code works for all transfers. If your branch uses a unique code, ADCB will inform you.

Q3: How long does an international transfer with ADCB take?

Typically, 1–3 business days. Delays can occur due to public holidays, time zones, or intermediary banks.

Q4: Is the SWIFT code the same as the IBAN?

No. The SWIFT code identifies the bank, while the IBAN identifies your specific account.

Q5: Can I receive international payments without a SWIFT code?

No. A SWIFT code is essential for routing the payment to the correct bank and account.

Final Thoughts

In the modern financial world, global connectivity is everything — and your SWIFT code is the bridge that connects you to it. Whether you’re receiving payments from overseas or sending money to another continent, knowing the ADCB swift code ensures your funds reach their destination quickly and securely.

As the UAE continues to grow as a financial powerhouse, services like ADCB’s international banking capabilities make it easier for individuals and businesses to operate without borders. And for anyone managing cross-border payments, the SWIFT code is more than just a technical detail — it’s a passport to the global economy.